IRS Offers Relief for Employers Hit by ERC Scams

In a bid to assist employers who have fallen prey to scams related to the Employee Retention Credit (ERC), the Internal Revenue Service (IRS) has introduced a new initiative. This decision comes after the IRS temporarily suspended the processing of new ERC claims due to a significant surge in submissions, largely driven by aggressive promotion from entities known as “ERC mills.”

Here’s a closer look at this development:

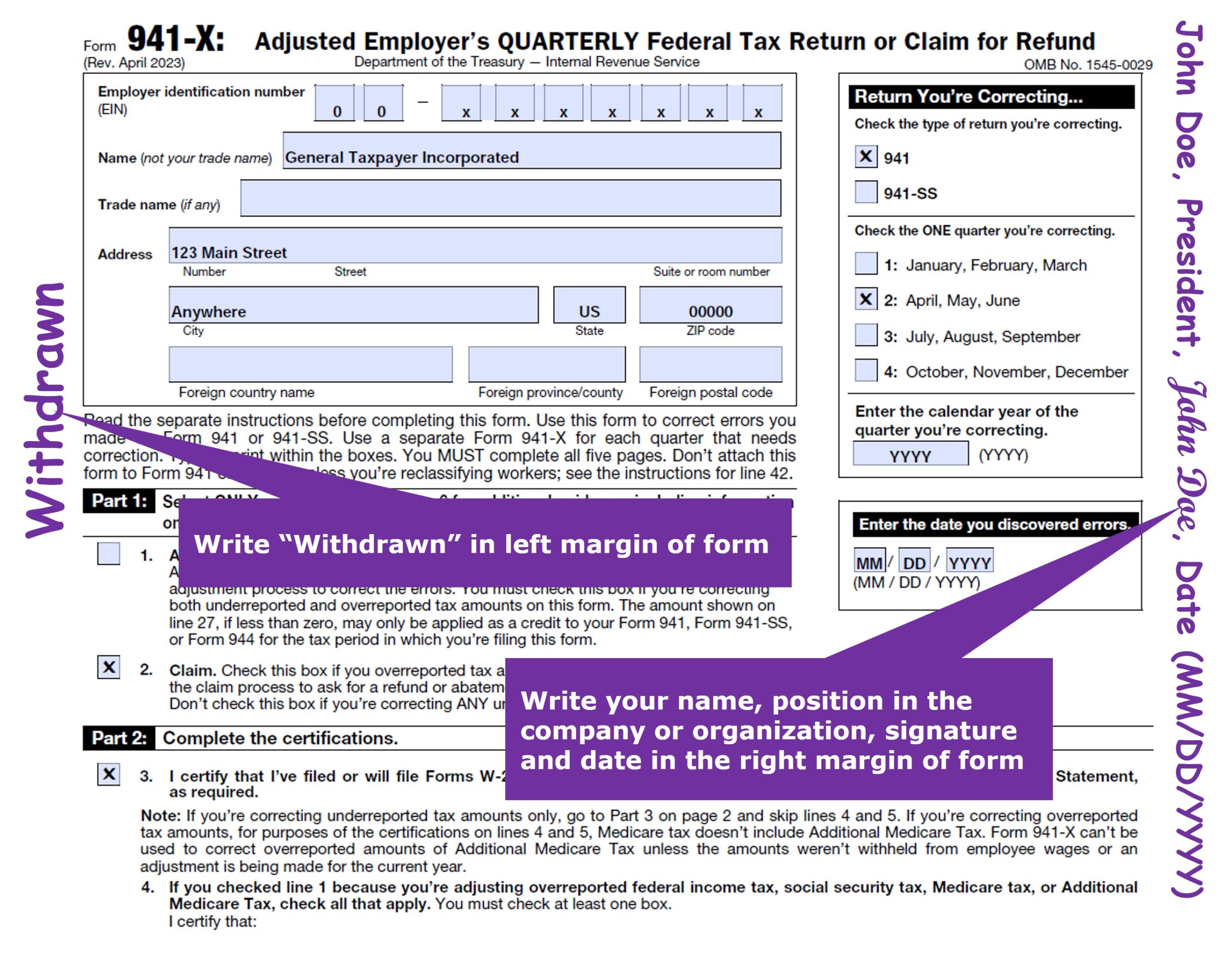

A Way Out: Employers who have already filed ERC claims but have yet to receive refunds can now opt to withdraw their submissions. This withdrawal option has been designed to help these employers steer clear of future repayment responsibilities, as well as interest and penalties.

Eligibility Criteria for Withdrawal: To qualify for the withdrawal process, employers must meet specific conditions:

- They must have submitted the ERC claim through an adjusted employment return (Forms 941-X, 943-X, 944-X, CT-1X).

- The adjusted return should have been filed exclusively to claim the ERC, with no other alterations.

- The employer must wish to withdraw the entire ERC claim.

- Importantly, the IRS should not have issued payment for their claim, or if payment was made, it shouldn’t have been cashed or deposited.

No Penalties or Interest: Employers who choose to withdraw their claims will not face any penalties or interest, and the IRS will treat these claims as if they were never submitted.

This IRS initiative aims to protect well-intentioned businesses that may have been misled by the aggressive marketing tactics of certain entities promoting the ERC. It underscores the importance of employers remaining cautious and well-informed about the ERC, while also avoiding costly loans or falling victim to scams.

For detailed instructions on how to withdraw an ERC claim and additional relevant information, please visit IRS.gov/withdrawmyERC.

The IRS remains committed to supporting small businesses and organizations as they navigate the complexities surrounding the Employee Retention Credit. If you have questions or require further assistance, please don’t hesitate to reach out.

Stay informed and stay protected.

Let’s find your way to tax and accounting peace of mind

Let us be part of your journey towards success.