Do You Need to File 1099-NEC Forms? A Quick Guide

Are you feeling puzzled about whether you need to file 1099-NEC forms this tax season? You’re not alone. The IRS has specific rules about who should file these forms, and it’s primarily a business filing requirement. If you’re an individual taxpayer, it’s essential to understand that 1099-NEC forms are typically related to business activities, so you might not need to worry about them if you’re not running a business. However, if you’re still unsure, let’s dive into the details to determine whether you should be filing these forms.

Who Needs to File 1099-NEC Forms?

1099-NEC forms, also known as Nonemployee Compensation forms, are typically used by businesses to report payments made to non-employees or independent contractors. If you operate a business, you might need to file these forms if you meet the following criteria:

1. You Paid a Non-Employee Over $600:

- If your business paid an individual or unincorporated business entity (like a sole proprietorship or partnership) $600 or more during the tax year for services provided, you must file a 1099-NEC form.

2. Non-Employee Workers:

- This form is mainly used to report payments made to freelancers, contractors, consultants, and other non-employee workers. It doesn’t apply to payments made to regular employees.

3. Payment Types:

- Payments reported on 1099-NEC forms typically include compensation for services, fees, commissions, prizes, awards, and more. It’s essential to report all payments made to non-employees for services rendered.

4. Business Expenses:

- If these payments are considered ordinary and necessary business expenses, you should report them on the 1099-NEC.

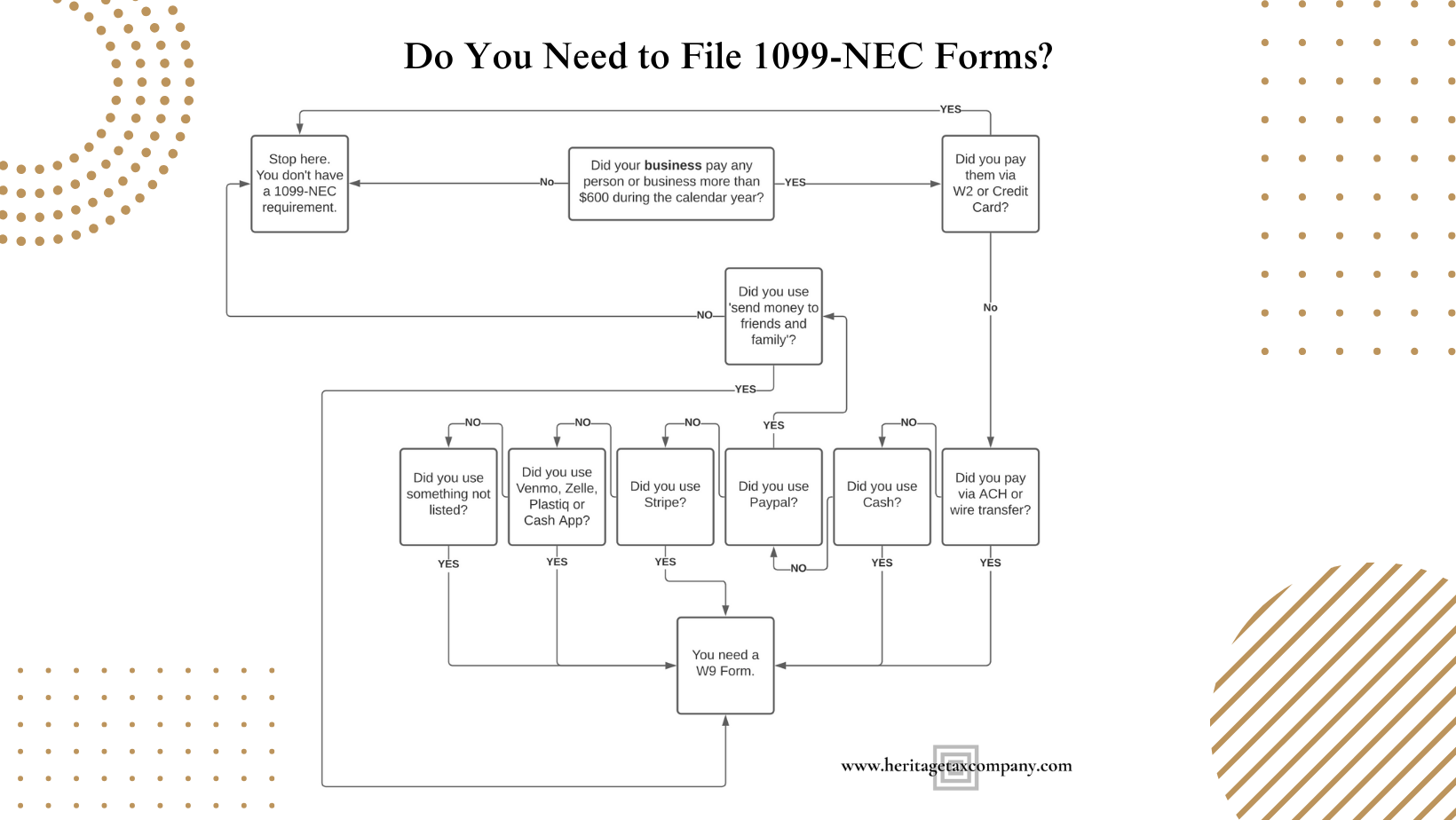

Flowchart: Do You Need to File 1099-NEC Forms?

To simplify the decision-making process, we’ve created a flowchart to help you determine if you need to file 1099-NEC forms:

Additional Considerations:

- Deadline: If you determine that you need to file 1099-NEC forms, be aware of the filing deadline. The forms must be provided to recipients by January 31st and submitted to the IRS by February 28th (or March 31st if filed electronically).

- Penalties: Failing to file 1099-NEC forms when required can result in penalties. It’s essential to meet the deadlines and provide accurate information.

Remember, this flowchart provides a general guideline. Tax laws and regulations can change, so it’s advisable to consult with a tax professional or visit the IRS website for the most up-to-date information. Properly filing 1099-NEC forms ensures compliance with tax regulations and helps you avoid potential penalties.

If you need help or would like to engage with us for this filing service, please contact us here.

Let’s find your way to tax and accounting peace of mind

Let us be part of your journey towards success.