Maine 2022 Minimum Wage Rates

What is the minimum wage?

-

Effective January 1, 2021, Minimum wage is $12.15 per hour.

-

Effective January 1, 2022, Minimum wage is $12.75 per hour.

-

See 26 MRS §663.3 for specific exemptions from the state minimum wage.

-

Special note: Exemptions from federal minimum wage may differ. For federal minimum wage information please contact the US DOL at 1-866-487-9243 or visit their website.

What is a service employee's minimum wage?

Effective January 1st, 2021 “Service employee” means any employee engaged in an occupation in which the employee customarily and regularly receives more than:

-

Prior to January 1, 2022, $30 a month in tips;

-

Beginning January 1, 2022, $100 a month in tips; or

-

Beginning January 1, 2023, $175 a month in tips.

On January 1st, and every January 1st thereafter, the monetary amount over which an employee is considered a service employee under this subsection must be increased by the same percentage of the increase, if any, in the cost of living. The increase in the cost of living is measured by the percentage increase, if any, as of August of the previous year over the level as of August of the year preceding that year in the Consumer Price Index for Urban Wage Earners and Clerical Workers, CPI-W, for the Northeast Region, or its successor index, as published by the United States Department of Labor, Bureau of Labor Statistics or its successor agency, with the amount of the increase rounded to the nearest multiple of $1.

Employers must pay service employees a direct service wage of at least 50% of the State Minimum Wage.

Effective January 1, 2022, the State Minimum Wage will be $12.75 per hour and the direct service wage cannot be less than $6.38 per hour.

If the employee's wages, when combined with actual tips received, do not average at least the State Minimum Wage at the end of the week, the employer must increase the direct service wage by the difference.

Tips belong to the employee providing the service to the customer. Valid tip pooling arrangements only is permissible among service employees.

Overtime (one and one-half times the regular rate of pay) is due on all hours worked over 40 in a workweek in most employment situations.

How many hours is full-time employment? How many hours is part-time?

Full-time and part-time employment is not generally defined. These are determined by the employer and are commonly used to define how company benefits are earned.

I feel that I have been unfairly discharged. What can I do?

Most employment is "at-will," which means an employer may hire or fire at will and an employee may decide to work or not work for a company at will. This means an employer may legally fire an employee without notice and cause.

An employer may not discriminate against an employee because of:

-

Race

-

Skin color

-

Gender

-

Sexual orientation

-

Age

-

Physical or mental disability

-

Genetic predisposition

-

Religion

-

Ancestry

-

National origin

If you feel your employer has discriminated against you based on one of these reasons, you should contact the Maine Human Rights Commission at 624-6290.

If you would like to file for unemployment benefits because you believe that you lost your job through no fault of your own, visit the Department’s Unemployment website.

My employer has changed my work schedule and pay -- is this legal?

Maine labor laws do not prohibit an employer from changing work hours or schedules. The rate of pay can be lowered when the employer gives at least a one-day advanced notice to the affected employee. An employer may never lower the rate below the established minimum wage.

My final paycheck is being held by the employer. What can I do?

All earned wages are due on the next regularly scheduled payday after the termination of employment. If the final payment of wages is to be made in check form, the employer must have that check available for the employee to pick up at the business location on the established payday. If the employer is going to mail the check, then the check must be mailed so that it reaches the employee’s actual address no later than the established payday. An employee who is denied payment on the established payday can call 623-7900 to talk with a Wage and Hour representative.

Who can be placed on salary?

There are two salary types. One is for employees (commonly referred to as non-exempt) whose job duties do not meet the Executive, Administrative or Professional exemptions established in 26 MRS §663 (K). Non-exempt salaried employees are paid a predetermined fixed amount regardless of the number of hours they work. However, if they work more than 40 hours in any given week, their salary must be converted to an hourly rate that cannot amount to less than the State Minimum Wage and they must be paid overtime for all hours worked in excess of 40 in any given week.

The second type is for employees (commonly referred to as exempt) whose primary job duties meet the Executive, Administrative or Professional exemptions established in 26 MRS §663(K). These employees are paid a predetermined fixed amount regardless of the hours worked. The minimum salary amount must be at least $735.59 per week as of January 1, 2022. Teachers and highly skilled computer staff may also be paid as exempt-salaried employees. Please check the Maine Wage and Hour Division Rules for specific guidance.

Is there a new minimum amount that salaried “exempt” workers must be paid?

As of January 1, 2022, the new minimum salary requirement is $735.59 per week. The previous minimum salary requirement as of January 1, 2021, was $700.97 per week.

Does my employer have to pay my earned paid-vacation, paid-holidays, or paid-sick leave?

Under Maine law, only the unused accrued vacation time is required to be paid upon termination in cases where the employer’s policy specifically states that the unused balance will be paid upon termination. Effective January 1st, 2021, employers must provide up to 40 hours of unrestricted Earned Paid Leave to all covered employees. There are some exceptions to this requirement.Visit the Bureau of Labor Standard’s Earned Paid Leave web page for more information.

How does a fixed salary pay arrangement with fluctuating hours work?

Fluctuating workweek overtime pay agreements are a way to comply with overtime requirements. The employee’s salary is meant to cover all hours worked in the week at straight time.

Example:

-

An employee receives a salary of $573.75 for 45 hours worked. This equates to $12.75 per hour (which must be at least the State Minimum Wage). In this example, one-half of the average hourly rate multiplied by the number of hours worked over 40 in that week would be paid to cover overtime; therefore, $12.75 divided by two equals $6.38. Multiply $6.38 by the 5 overtime hours worked and you get $31.90 of additional overtime wages due. The employee would be paid $573.75 + $31.90 = $605.65 gross wages for that week. However, when the hours worked are below 40, for example, 38 hours, the employee is still paid the guaranteed $573.75 for the week and no overtime would be due.

-

In a fluctuating workweek overtime pay agreement, an employer will pay the guaranteed salary to the employee in weeks where the employee works fewer than 40 hours. In this agreement, the average hourly rate cannot be less than the State Minimum Wage rate currently in effect.

-

More detail can be found in Federal Law under 29 CFR 778.114 or by calling Maine’s Wage& Hour Division at 623-7900.

-

Each workweek stands alone, so true and accurate time records must be maintained and a clear agreement with the employee(s) should be in place.

IRS issues information letters to Advance Child Tax Credit recipients and recipients of the third round of Economic Impact Payments

IR-2021-255, December 22, 2021

WASHINGTON — The Internal Revenue Service announced today that it will issue information letters to Advance Child Tax Credit recipients starting in December and to recipients of the third round of the Economic Impact Payments at the end of January. Using this information when preparing a tax return can reduce errors and delays in processing.

The IRS urged people receiving these letters to make sure they hold onto them to assist them in preparing their 2021 federal tax returns in 2022.

Watch for advance Child Tax Credit letter

To help taxpayers reconcile and receive all of the Child Tax Credits to which they are entitled, the IRS will send Letter 6419, 2021 advance CTC, starting late December 2021 and continuing into January. The letter will include the total amount of advance Child Tax Credit payments taxpayers received in 2021 and the number of qualifying children used to calculate the advance payments. People should keep this and any other IRS letters about advance Child Tax Credit payments with their tax records.

Families who received advance payments will need to file a 2021 tax return and compare the advance Child Tax Credit payments they received in 2021 with the amount of the Child Tax Credit they can properly claim on their 2021 tax return.

The letter contains important information that can make preparing their tax returns easier. People who received the advance CTC payments can also check the amount of their payments by using the CTC Update Portal available on IRS.gov.

Eligible families who did not receive any advance Child Tax Credit payments can claim the full amount of the Child Tax Credit on their 2021 federal tax return, filed in 2022. This includes families who don't normally need to file a tax return.

Economic Impact Payment letter can help with the Recovery Rebate Credit

The IRS will begin issuing Letter 6475, Your Third Economic Impact Payment, to EIP recipients in late January. This letter will help Economic Impact Payment recipients determine if they are entitled to and should claim the Recovery Rebate Credit on their tax year 2021 tax returns that they file in 2022.

Letter 6475 only applies to the third round of Economic Impact Payments that was issued starting in March 2021 and continued through December 2021. The third round of Economic Impact Payments, including the "plus-up" payments, were advance payments of the 2021 Recovery Rebate Credit that would be claimed on a 2021 tax return. Plus-up payments were additional payments the IRS sent to people who received a third Economic Impact Payment based on a 2019 tax return or information received from SSA, RRB or VA; or to people who may be eligible for a larger amount based on their 2020 tax return.

Most eligible people already received the payments. However, people who are missing stimulus payments should review the information to determine their eligibility and whether they need to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Like the advance CTC letter, the Economic Impact Payment letters include important information that can help people quickly and accurately file their tax return.

More information about the advance Child Tax Credit, Economic Impact Payments and other COVID-19-related tax relief may be found at IRS.gov.

As the 2022 tax filing season approaches, the IRS urges people to make sure to file an accurate tax return and use electronic filing with direct deposit to avoid delays.

Four Ways Freelancers and Gig Workers Can Trim Their Tax Bills

It is hard to beat the freedom and flexibility of freelancing and gig work. When you work for yourself, you can set your own hours, turn your home into an office and even ditch the daily commute.

All that is great, but there is one thing about freelancing that is much less pleasant. Compared to their corporate counterparts, self-employed individuals face an additional tax burden, an expense that takes many of them by surprise.

Note: If you end up falling behind on your taxes and the IRS or state claim you owe $10,000 or more, reach out to our tax resolution firm and we’ll schedule a free, no-obligation confidential consultation.

If you love the freedom of gig work but not the big tax bill, you need to think ahead. A little proactive planning can go a long way, so you can keep more of your hard-earned money in your pocket. Here are four smart strategies you can use to trim your tax liability and get more out of your freelancing and gig work.

#1. Fund a Health Savings Account

If you work for someone else, there is a good chance your boss picks up part of your health insurance costs, but freelancers and gig workers do not have that luxury. These self-employed individuals face additional challenges when it comes to health care, seeking affordable policies on the open market and saving money where they can.

One way the self-employed can save money and trim their tax bills is with a health savings account. Eligible individuals can contribute to a health savings account on a pre-tax basis, taking a serious tax deduction while making their health care more affordable. This tax savings can be a very big deal.

#2. Contribute to a Retirement Fund for the Self-Employed

Freelancers and gig workers need to look out for their own retirement, but there are plenty of options available. The annual contribution limits on retirement plans for the self-employed are among the most generous around, so you may be able to shelter a significant portion of your earnings from the tax man.

If you have a tax ID for your freelance business, you may be able to contribute to a solo 401(k). This plan works much the same as a traditional 401(k) plan, but the contribution limits could be even higher. Even if you do not have a tax ID, you can shelter part of your freelance or gig work income with a SEP-IRA or similar retirement plan.

#3. Take the Home Office Deduction

If you work out of your home, taking the home office deduction could save you a lot of money. If you are eligible for this valuable deduction, you could write off a portion of your property taxes and other home ownership costs, reducing your tax bill and keeping more money in your pocket.

There are specific rules regarding the home office deduction, so check with your tax preparer to make sure you qualify. If you can take the deduction, be sure to keep accurate records, and take photos of the office in your home.

#4. Push Income Into the Next Year

Freelance income can be notoriously unpredictable. One month is great, while the next is terrible. Yearly earnings can be just as variable, making tax planning difficult.

If you are having a particularly good year, you may be able to reduce your current tax bill by pushing some of that income into the following 12 months. When the end of the year approaches, delaying client invoices and moving income into the next year could save you money in the long run.

Once again, it is important to consult a tax professional before implementing this strategy. The IRS has established strict rules concerning income reporting, and you do not want to run afoul of the tax agency.

As a self-employed individual, you face some serious tax challenges, including the dreaded self-employment tax. That higher tax burden makes smart planning essential, and you can start that planning with the four tips listed above.

Owe Back Taxes and Need Tax Relief?

If you want an expert tax resolution specialist who knows how to navigate the IRS maze, reach out to our firm and we’ll schedule a no-obligation confidential consultation to explain your options to permanently resolve your tax problem.

IRS warns: Deferred payroll taxes due in December

The Internal Revenue Service is sending notices to taxpayers who deferred their Social Security taxes last year, reminding them that half the taxes will be due by the end of this year.

In an email to payroll professionals Friday, the IRS said that it’s sending informational-only CP256V Notices to self-employed individuals and household employers who chose to defer paying some Social Security taxes under the CARES Act in October and November. The notice reminds them that the first installment of deferred Social Security taxes will be due by the end of December and the remainder by the end of next year.

In an email to payroll professionals Friday, the IRS said that it’s sending informational-only CP256V Notices to self-employed individuals and household employers who chose to defer paying some Social Security taxes under the CARES Act in October and November. The notice reminds them that the first installment of deferred Social Security taxes will be due by the end of December and the remainder by the end of next year.

The payroll tax deferral helped taxpayers who found they desperately needed funds to pay their regular expenses during the first year of the pandemic. However, many tax professionals advised their clients that the taxes would eventually come due. The payroll tax relief in the CARES Act for employers differed from the payroll tax holiday that former President Trump issued by executive order in August of last year for employees, which required repayment of the deferred taxes by the end of April 2021. Federal government employees and members of the military were automatically subject to that payroll tax holiday, but most taxpayers and companies avoided opting for it last year, knowing the taxes would eventually have to be paid.

“The CARES Act allowed these types of taxpayers to defer the payment of certain Social Security taxes on their Form 1040 for tax year 2020 over the next two years,” said the IRS. “Half of the deferred Social Security tax is due by Dec. 31, 2021, and the remainder is due by Dec. 31, 2022.”

What you need to do

- Pay your current installment amount by the due date shown on the notice. Note: the notice may not reflect recent payments, but they will still be recorded correctly on your account.

- Review your tax return for the tax period in which you deferred Social Security taxes and subtract any payments you've made. Compare that figure with the amounts shown on your notice. If you discover an error, please contact us at the telephone number shown on the notice.

What you need to know

- The first installment amount, due December 31, 2021, is half the employer's share of Social Security taxes you could have deferred (which includes any amount of the employee's share of Social Security taxes deferred under Notice 2020-65, as modified by Notice 2021-11) minus all deposits and payments we've received. For more information, please review Q&A 18 at IRS.gov/etd.

- The second installment, due December 31, 2022, is the remaining unpaid deferred taxes.

Frequently asked questions

Do I have to reply to this notice?

No, this is a courtesy notice for your information only. No response is needed.

How do I make my repayment?

You can make the deferral payments through the Electronic Federal Tax Payment System (EFTPS), by credit or debit card, or with a check or money order. Note: you must make these payments separate from other tax payments to ensure they're applied to the deferred payroll tax balance. IRS systems won't recognize the payment if it's with other tax payments or sent as a deposit.

To make the deferred payment using EFTPS, select deferral payment and change the date to the applicable tax period for the payment.

If the employee no longer works for the organization, you must repay the entire deferred amount of the employee's portion of Social Security tax then collect the employee's portion using your own recovery methods.

How do I make a payment for a deferred amount on an aggregate return?

Third-party payers (such as an Internal Revenue Code Section 3504 agent, a certified professional employer organization, a non-certified professional employer organization, or other agents designated with Form 2678, Employer/Payer Appointment of Agent) file aggregate returns to show the employer's deferred tax.

Employers should coordinate with their third-party payer to pay deferred taxes owed by the December 31, 2021, and December 31, 2022, due dates. This helps ensure the third party properly records the payment and the correct employer identification number (EIN) and tax period are noted with the payment so the IRS can apply it properly.

Employers should continue coordinating with their third-party payer to ensure payments are applied under the third party's EIN (unless the employer receives an IRS notification stating the unpaid deferral amount has been moved to their EIN).

What if I cannot pay my deferred taxes?

You may be eligible for a payment plan or other payment options. Note: if the IRS doesn’t receive your payment by the applicable due dates, the deferred taxes may be subject to Failure to Deposit penalties.

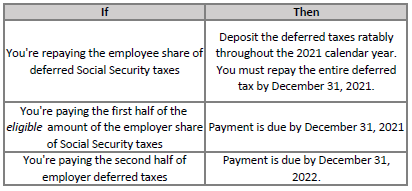

When should I repay deferred taxes?

The following table shows the schedule for repayment:

Penalties and interest begin accruing on the day payments are due if they aren't timely paid.

How do third-party payers report unpaid deferred amounts from aggregate returns?

Employers are solely responsible for payment of the deferred taxes they requested for any wages paid by the third-party payer. If the third-party payer filed an aggregate return and receives a balance due notice for the employer's unpaid portion of deferred Social Security tax, the third-party may notify the IRS by eFaxing the following information with a coversheet to 844-255-1856:

- Copy of the Schedule R (Form 941 or 943) for relevant tax periods

- Client (common law employer) name, EIN, and current address

- Total deferred amount per tax period

- Unpaid part of the deferred amount, per tax period

- List of deferral payments by client or by the third-party payer on behalf of client(dates and amounts), per tax period

- If applicable, date client separated from aggregate filer

Year-End Individual Tax Planning

It is getting to be that time of year to review your tax situation and explore options to minimize your tax bill.

Due to the enactment of legislation to offset the economic burden wrought by COVID-19, there is a lot to consider when reviewing year-end tax planning options. Pandemic-related tax breaks include an expanded dependent care assistance, payroll tax credits for self-employed individuals, substantial increases in the child tax credit and the earned income tax credit, $1,400 recovery rebates for many taxpayers, and an exclusion from income for certain student loan forgiveness, to name just a few.

Due to the enactment of legislation to offset the economic burden wrought by COVID-19, there is a lot to consider when reviewing year-end tax planning options. Pandemic-related tax breaks include an expanded dependent care assistance, payroll tax credits for self-employed individuals, substantial increases in the child tax credit and the earned income tax credit, $1,400 recovery rebates for many taxpayers, and an exclusion from income for certain student loan forgiveness, to name just a few.

Presently, Congress is engaged in negotiations on a tax and spending bill that would likely result in major tax changes beginning next year. Should such a bill pass, we will want to factor such changes into our year-end planning. For now, we'll need to base our planning on existing law.

The following are some of the considerations we should explore when discussing the tax breaks from which you may benefit, as well as the strategies we can employ to help minimize your taxable income and resulting federal tax liability.

2021 Recovery Rebate

Under American Rescue Plan (ARP) Act, passed in March, individuals with income under a certain level are entitled to a recovery rebate tax credit. These are direct payments (sometimes referred to as "stimulus checks") to individuals by the government.

Single individuals and joint filers are entitled to a payment of $1,400 for each eligible individual. An eligible individual is any individual other than (1) a nonresident alien, (2) a dependent of another taxpayer, and (3) an estate or trust. For these purposes, the term "dependent" includes not just children but qualifying relatives. The amount of the recovery rebate phases out for income over a certain level. The 2021 recovery rebate began phasing out starting at $75,000 of adjusted gross income (AGI) for an individual ($112,500 for heads of household and $150,000 in the case of a joint return or surviving spouse) and was completely phased out where an individual's AGI is $80,000 ($120,000 for heads of household and $160,000 in the case of a joint return or surviving spouse).

The government began issuing the rebates based on 2019 income tax returns, or 2020 returns for individuals who filed their 2020 returns in time. The calculation for the correct amount of the rebate will be part of your 2021 tax return. If your 2021 tax return indicates a rebate larger than your stimulus check (because, for example, your income went down or you had another child), any additional amount will be claimed as a credit against your 2021 tax bill. On the flip side, if the 2021 rebate calculation shows an amount in excess of what you were entitled to, you do not have to repay that excess.

Filing Status

Your tax return filing status can impact the amount of taxes you pay. For example, if you qualify for head-of-household (HOH) filing status, you are entitled to a higher standard deduction and more favorable tax rates. To qualify as HOH, you must be unmarried or considered unmarried (i.e., legally separated or living apart from a spouse) and provide a home for certain other persons. If you are in such a situation, we need to review whether you qualify for HOH filing status.

If you are married, you'll either be filing your return using the married filing jointly or married filing separately filing status. Generally, married filing separately is not beneficial for tax purposes, but in some unique cases, such as when one party earns substantially less or when one party may be subject to IRS penalties for issues relating to tax reporting, it may be advantageous to file as married filing separately. Additionally, if one spouse was not a full-year U.S. resident, an election is available to file a joint tax return where such joint filing status would otherwise not apply and this may help reduce a couple's tax liability.

Income, Deductions, and Credits

Standard Deduction versus Itemized Deductions. The Tax Cuts and Jobs Act of 2017 (TCJA) substantially increased the standard deduction amounts, thus making itemized deductions less attractive for many individuals. For 2021, the standard deduction amounts are: $12,550 (single); $18,800 (head of household); $25,100 (married filing jointly); and $12,550 (married filing separately). An additional standard deduction amount of $1,350 applies for taxpayers who are 65 or older or blind. This additional amount is increased to $1,700 if the individual is also unmarried and not a surviving spouse. If the taxpayer is 65 or older and blind, the deduction is doubled.

If the total of your itemized deductions in 2021 will be close to your standard deduction amount, we should evaluate whether alternating between bunching itemized deductions into 2021 and taking the standard deduction in 2022 (or vice versa) could provide a net-tax benefit over the two-year period. For example, you might consider doubling up this year on your charitable contributions rather than spreading the contributions over a two-year period. If these contributions, along with your mortgage interest, medical expenses (discussed below), and state income and property taxes (subject to the $10,000 deduction limitation on such taxes that applies to both single individuals and married couples filing jointly; and the $5,000 limitation on such expenses for married filing separately returns), exceed your standard deduction, then itemizing such expenses this year and taking the standard deduction next year may be appropriate.

Medical Expenses, Health Savings Accounts, and Flexible Savings Accounts. As a result of the COVID-19 pandemic, a number of individuals have incurred more medical expenses than usual. For 2021, our-of-pocket medical expenses you have paid in 2021 are deductible as an itemized deduction to the extent they exceed 7.5 percent of your adjusted gross income. To be deductible, medical care expenses must be primarily to alleviate or prevent a physical or mental disability or illness. They don't include expenses that are merely beneficial to general health, such as vitamins or a vacation. Deductible expenses include not only hospitalization expenses, but also health insurance premiums and the amounts you pay for transportation to get medical care. Medical expenses also include amounts paid for qualified long-term care services and limited amounts paid for any qualified long-term care insurance contract. Depending on what your taxable income is expected to be in 2021 and 2022, and whether itemizing deductions would be advantageous for you in either year, you may want to accelerate any optional medical expenses into 2021 or defer them until 2022. The right approach depends on your income for each year, expected medical expenses, as well as your other itemized deductions.

Medical Expenses, Health Savings Accounts, and Flexible Savings Accounts. As a result of the COVID-19 pandemic, a number of individuals have incurred more medical expenses than usual. For 2021, our-of-pocket medical expenses you have paid in 2021 are deductible as an itemized deduction to the extent they exceed 7.5 percent of your adjusted gross income. To be deductible, medical care expenses must be primarily to alleviate or prevent a physical or mental disability or illness. They don't include expenses that are merely beneficial to general health, such as vitamins or a vacation. Deductible expenses include not only hospitalization expenses, but also health insurance premiums and the amounts you pay for transportation to get medical care. Medical expenses also include amounts paid for qualified long-term care services and limited amounts paid for any qualified long-term care insurance contract. Depending on what your taxable income is expected to be in 2021 and 2022, and whether itemizing deductions would be advantageous for you in either year, you may want to accelerate any optional medical expenses into 2021 or defer them until 2022. The right approach depends on your income for each year, expected medical expenses, as well as your other itemized deductions.

You may also want to consider health saving accounts (HSAs) if you don't already have one. These are tax-advantaged accounts which help individuals who have high-deductible health plans. If you are eligible to set up such an account, you can deduct the amount you contribute to the account in computing adjusted gross income. These contributions are deductible whether you itemize deductions or not. Distributions from an HSA are tax free to the extent they are used to pay for qualified medical expenses (i.e., medical, dental, and vision expenses). For 2021, the annual contribution limits are $3,600 for an individual with self-only coverage and $7,200 for an individual with family coverage.

In addition, if you are not already doing so and your employer offers a Flexible Spending Account (FSA), consider setting aside some of your earnings tax free in such an account so you can pay medical and dental bills with pre-tax money. The maximum amount that the IRS will allow to be set aside for 2021 limit is $2,750. Since you don't pay taxes on this money, you'll save an amount equal to the taxes you would have paid on the money you set aside. FSA funds can be used to pay deductibles and co-payments, but not for insurance premiums. You can also spend FSA funds on prescription medications, as well as over-the-counter medicines, generally with a doctor's prescription. Reimbursements for insulin are allowed without a prescription. Finally, FSAs may also be used to cover costs of medical equipment like crutches, supplies like bandages, and diagnostic devices like blood sugar test kits.

Charitable Contributions. While the tax benefits of making charitable contributions and taking an itemized deduction for such contributions were tamped down as a result of the increases made to the standard deduction amounts, a law passed at the end of 2020 modified the charitable contribution rules for 2021 tax returns. As a result, eligible individuals can claim an above-the-line deduction of up to $300 ($600 in the case of a joint return) for qualified charitable contributions made during 2021. An eligible individual is an individual who does not elect to itemize deductions. Thus, absent this provision, anyone taking the standard deduction would be ineligible to take a charitable contribution deduction. A qualified charitable contribution is a cash contribution paid in 2021 to an eligible charitable organization. Contributions of non-cash property, such as securities, are not qualified contributions.

Charitable Contributions. While the tax benefits of making charitable contributions and taking an itemized deduction for such contributions were tamped down as a result of the increases made to the standard deduction amounts, a law passed at the end of 2020 modified the charitable contribution rules for 2021 tax returns. As a result, eligible individuals can claim an above-the-line deduction of up to $300 ($600 in the case of a joint return) for qualified charitable contributions made during 2021. An eligible individual is an individual who does not elect to itemize deductions. Thus, absent this provision, anyone taking the standard deduction would be ineligible to take a charitable contribution deduction. A qualified charitable contribution is a cash contribution paid in 2021 to an eligible charitable organization. Contributions of non-cash property, such as securities, are not qualified contributions.

In addition, if you are itemizing your deductions and have substantial charitable contributions, the new rules modified the percentage limitation rules that could otherwise limit your charitable contribution deduction. As a result, for charitable contributions made during 2021, any qualified contribution is allowed as a deduction to the extent that the aggregate of such contributions does not exceed the excess of your charitable contribution base over the amount of all other charitable contributions. Excess contributions are eligible for a five-year carryover.

As in prior years, you can reap a larger tax benefit by donating appreciated assets, such as stock, to a charity. Generally, the higher the appreciated value of an asset, the bigger the potential value of the tax benefit. Donating appreciated assets not only entitles you to a charitable contribution deduction but also helps you avoid the capital gains tax that would otherwise be due if you sold your stock. For example, if you own stock with a fair market value of $1,000 that was purchased for $250 and your capital gains tax rate is 15 percent, the capital gains tax you would owe if you sold that stock is $113 ($750 gain x 15%). If you donate that stock instead of selling it, and are in the 24 percent tax bracket, your ordinary income deduction is worth $240 ($1,000 FMV x 24% tax rate). You also save the $113 in capital gains tax that you would otherwise pay if you sold the stock; that amount goes to the charity. Thus, the after-tax cost of the gift of appreciated stock is $647 ($1,000 - $240 - $113) compared to the after-tax cost of a donation of $1,000 cash which would be $760 ($1,000 - $240). However, it's important to also keep in mind that tax deductions for contributions of appreciated long-term capital gain property may be limited to a certain percentage of your adjusted gross income depending on the amount of the deduction.

Finally, if you have an individual retirement account and are 70 1/2 years old and older, you are eligible to make a charitable contribution directly from your IRA. This is more advantageous than taking a distribution and making a donation to the charity that may or may not be deductible as an itemized deduction. If your itemized deductions, including the contribution, are less than your standard deduction, then you receive no tax benefit from taking a taxable distribution and donating that distribution. By making the donation directly from your IRA to a charity, you eliminate having the IRA distribution included in your income. This in turn reduces your adjusted gross income (AGI). Because various tax-related items, such as the medical expense deduction or the taxability of social security income or the 3.8 percent net investment income tax, are calculated based on your AGI, a reduced AGI can potentially increase your medical expense deduction, reduce the tax on social security income, and reduce any net investment income tax.

Expenses Incurred While Working from Home. Although more people have been working from home this year due to the pandemic, related expenses are not deductible if you are an employee. However, if you are self-employed and worked from home during the year, tax deductions are still available. Thus, if you have been working from home as an independent contractor, we should discuss what expenses you have incurred that might offset that taxable income.

Mortgage Interest Deduction. If you sold your principal residence during the year and acquired a new principal residence, the deduction for any interest on your acquisition indebtedness (i.e., your mortgage) could be limited. The interest deduction on mortgages of more than $750,000 obtained after December 14, 2017, is limited to the portion of the interest allocable to $750,000 ($375,000 in the case of married taxpayers filing separately). If you have a mortgage on a principle residence acquired before December 15, 2017, the mortgage interest limitation applies to mortgages of $1,000,000 ($500,000 in the case of married taxpayers filing separately) or less. However, if you operate a business from your home, an allocable portion of your mortgage interest is not subject to these limitations.

Interest on Home Equity Indebtedness. You can potentially deduct interest paid on home equity indebtedness, but only if you used the debt to buy, build, or substantially improve your home. Thus, for example, interest on a home equity loan used to build an addition to your existing home is typically deductible, while interest on the same loan used to pay personal expenses, such as credit card debt, is not.

Sale of a Home. If you sold your home this year, up to $250,000 ($500,000 for married filing jointly) of the gain on the sale is excludible from income. However, this amount is reduced if part of your home was rented out or used for business purposes. Generally, a loss on the sale of a home is not deductible. But again, if you rented part of your home or otherwise used it for business, the loss attributable to that portion of the home is deductible.

Discharge of Qualified Principal Residence Indebtedness. If you had any qualified principal residence indebtedness which was discharged in 2021, it is not includible in gross income.

Deductions for Mortgage Insurance Premiums. You may be entitled to treat amounts paid during the year for any qualified mortgage insurance as deductible qualified residence interest if the insurance was obtained in connection with acquisition debt for a qualified residence.

Deductions for Excess Business Losses. The ARP allows taxpayers other than corporations to deduct excess farm losses and excess business losses through 2027. An excess business loss for the tax year is the excess of aggregate deductions attributable to your trades or businesses over the sum of your aggregate gross income or gain plus a threshold amount. The threshold amount for 2021 is $262,000 or $524,000 for joint returns.

Qualified Business Income Passthrough Tax Break. Under the qualified business income tax break, a 20 percent deduction is allowed for qualified business income from sole proprietorships, S corporations, partnerships, and LLCs taxed as partnerships. If you qualify for the deduction, which is available to both itemizers and nonitemizers, it is taken on your individual tax return as a reduction to taxable income. This tax break is subject to some complicated restrictions and limitations, but the rules that apply to individuals with taxable income at or below $164,900 ($329,800 for joint filers; $164,925 for married individuals filing separately) are simpler and more permissive than the ones that apply to individuals with taxable income above those thresholds.

Child Tax Credit. The ARP significantly increased the child tax credit (CTC) available in 2021. The CTC was increased from $2,000 to $3,000 or, for children under 6, to $3,600. The age of a child for which the credit is available was raised from 16 to 17. Further, the refundable amount of the 2021 CTC equals the entire credit amount, rather being based on an earned income formula. Under modified phase-out rules, the modified adjusted gross income threshold which determines if an individual qualifies for the CTC was reduced to $150,000 in the case of a joint return or surviving spouse, $112,500 in the case of a head of household, and $75,000 in any other case. This special phase-out reduction is limited to the lesser of the applicable credit increase amount (i.e., either $1,000 or $1,600) or 5 percent of the applicable phase-out threshold range.

Taxpayers with refundable child tax credits may be eligible to receive advance payments of the credit.

Earned Income Credit. The ARP also expanded eligibility for the earned income tax credit (EITC) in 2021 and increased the amount of the credit available. For 2021, the minimum age to claim the so-called "childless EITC" for workers without qualifying children (i.e., dependent children who live with the taxpayer for more than half the year) is reduced from 25 to 19 (except for certain full-time students) and the upper age limit for the childless EITC is eliminated. In addition, the childless EITC amount has been increased so that the maximum EITC for 2021 for a childless individual is now $1,502.

The ARP also repealed a provision which prohibited an otherwise EITC-eligible taxpayer with qualifying children from claiming the childless EITC if he or she could not claim the EITC with respect to qualifying children due to failure to meet child identification requirements (including a valid SSN for qualifying children). This prohibition no longer applies.

Finally, the ARP increased to $10,000 the amount of investment income a person could have and still qualify for the EITC. In addition, taxpayers can compute their EITC amount for 2021 by substituting their 2019 earned income for their 2021 earned income, if 2021 earned income is less than 2019 earned income.

Dependent Care Assistance Tax Benefits. The ARP provided a number of favorable changes to tax benefits relating to dependent care assistance, including: (1) making the child and dependent care tax credit (CDCTC) refundable; (2) increasing the amount of expenses eligible for the CDCTC; (3) increasing the maximum rate of the CDCTC; (4) increasing the applicable percentage of expenses eligible for the CDCTC; and (5) increasing the exclusion from income for employer-provided dependent care assistance.

Generally, you may be eligible for a nonrefundable CDCTC for up to 35 percent of the expenses paid to someone to care for your child or your dependent so that you can work or look for work. For 2021, the dependent care credit is refundable for an individual who lives in the United States for more than one-half of the tax year. Under the ARP, the amount of child and dependent care expenses that are eligible for the credit was increased to $8,000 for one qualifying individual and $16,000 for two or more qualifying individuals. The maximum credit rate also goes up from 35 to 50 percent and a phaseout thresholds begin at $125,000 of adjusted gross income (i.e., household income). At $125,000, the credit percentage begins to phase out, and plateaus at 20 percent. This 20-percent credit rate phases out for taxpayers whose adjusted gross income is in excess of $400,000. In addition, the amount of employer-provided dependent care assistance that may be excluded from income has been increased from $5,000 to $10,500 (from $2,500 to $5,250 in the case of a separate return filed by a married individual) for 2021.

Premium Tax Credit. A health insurance subsidy is available through a premium assistance credit for eligible individuals and families who purchase health insurance through insurance Exchanges offered under the Patient Protection and Affordable Care Act (PPACA). The premium assistance credit is refundable and payable in advance directly to the insurer on the Exchange. Individuals with incomes exceeding 400 percent of the poverty level are normally not eligible for these subsidies. However, the ARP eliminated that provision for tax years beginning in 2021 or 2022 and allows anyone to qualify for the subsidy. In addition, the provision limits the percentage of a person's income paid for health insurance under a PPACA plan to 8.5 percent of income.

Education-Related Deductions and Credits. Certain education-related tax deductions, credits, and exclusions from income may apply for 2021. Tax-free distributions from a qualified tuition program, also referred to as a Section 529 plan, of up to $10,000 are allowed for qualified higher education expenses. Qualified higher education expenses for this purpose include tuition expenses in connection with a designated beneficiary's enrollment or attendance at an elementary or secondary public, private, or religious school, i.e., kindergarten through grade 12. It also includes expenses for fees, books, supplies, and equipment required for the participation in certain apprenticeship programs and qualified education loan repayments in limited amounts. A special rule allows tax-free distributions to a sibling of a designated beneficiary (i.e., a brother, sister, stepbrother, or stepsister). As a result, a 529 account holder can make a student loan distribution to a sibling of the designated beneficiary without changing the designated beneficiary of the account.

Education-Related Deductions and Credits. Certain education-related tax deductions, credits, and exclusions from income may apply for 2021. Tax-free distributions from a qualified tuition program, also referred to as a Section 529 plan, of up to $10,000 are allowed for qualified higher education expenses. Qualified higher education expenses for this purpose include tuition expenses in connection with a designated beneficiary's enrollment or attendance at an elementary or secondary public, private, or religious school, i.e., kindergarten through grade 12. It also includes expenses for fees, books, supplies, and equipment required for the participation in certain apprenticeship programs and qualified education loan repayments in limited amounts. A special rule allows tax-free distributions to a sibling of a designated beneficiary (i.e., a brother, sister, stepbrother, or stepsister). As a result, a 529 account holder can make a student loan distribution to a sibling of the designated beneficiary without changing the designated beneficiary of the account.

In addition, if your modified adjusted gross income level is below certain thresholds, the following are also available for 2021: an American Opportunity Tax Credit of up to $2,500 per year for each eligible student; a Lifetime Learning credit of up to $2,000 for tuition and fees paid for the enrollment or attendance of yourself, your spouse, or your dependents for courses of instruction at an eligible educational institution; an exclusion from income for education savings bond interest received; and a deduction from gross income for student loan interest of up to $2,500. In addition, under the ARP, certain discharges of students loans occurring in years 2021 through 2025 are excludible from income.

Credit for Sick Leave for Self-Employed Individuals. As a result of the COVID-19 pandemic, special income tax credits were enacted for self-employed individuals. If you are considered an eligible self-employed individual, you may qualify for an income tax credit for a qualified sick leave equivalent amount. You are an eligible self-employed individual if you regularly carry on any trade or business and would be entitled to receive paid leave during the tax year under the Emergency Paid Sick Leave Act added by the Families First Act. The calculation of the qualified sick leave equivalent amount is quite complicated but is generally equal to the number of days during the tax year that you could not perform services for which you would have been entitled to sick leave, multiplied by the lesser of two amounts: (1) $511, or (2) 100 percent of your average daily self-employment income. The number of days taken into account in determining the qualified sick leave equivalent amount may not generally exceed 10 days. Your average daily self-employment income under this provision is an amount equal to the net earnings from self-employment for the year divided by 260. In addition, if you have appropriate documentation, the credit is refundable.

Credit for Family Leave for Certain Self-Employed Individuals. Another coronavirus-related income tax credit that may be available to you is a credit for a qualified family leave equivalent amount with respect to wages paid before October 1, 2021. The qualified family leave equivalent amount is an amount equal to the number of days (up to 50) during the tax year that you could not perform services for which you would be entitled, if you were employed by an employer, to paid leave under the Emergency Family and Medical Leave Expansion Act, multiplied by the lesser of two amounts: (1) 67 percent of your average daily self-employment income for the tax year, or (2) $200. Your average daily self-employment income under the provision is an amount equal to your net earnings from self-employment for the year divided by 260. This credit is also refundable.

Retirement Planning

If you can afford to do so, investing the maximum amount allowable in a qualified retirement plan will yield a large tax benefit. If your employer has a 401(k) plan and you are under age 50, you can defer up to $19,500 of income into that plan for 2021. Catch-up contributions of $6,500 are allowed if you are 50 or over. If you have a SIMPLE 401(k), the maximum pre-tax contribution for 2021 is $13,500. That amount increases to $16,500 if you are 50 or older. The maximum IRA deductible contribution for 2021 is $6,000 and that amount increases to $7,000 if you are 50 or over.

Life Events

Life Events

Life events can have a significant impact on your tax liability. For example, if your filing status last year was Head of Household or Surviving Spouse and your filing status for 2021 is Single, then your tax rate will go up. If you married or divorced during the year and changed your name, you need to notify the Social Security Administration (SSA). Similarly, the SSA should be notified if you have a dependent whose name has been changed. A mismatch between the name shown on the tax return and the SSA records can cause problems in the processing of tax returns and may even delay tax refunds. If you have been impacted by a life event, such as a birth or death in your family, the loss of a job or a change in jobs, or if you retired during the year, all of these can affect your tax situation.

Conclusion

Please call at your convenience so we can set up an appointment to discuss your 2021 tax return and determine if any estimated tax payment may be due before year end.

How Biden's Build Back Better Plan Would Tax the Rich

Key Points:

-

President Joe Biden issued a $1.75 trillion social and climate spending plan on Thursday. About $1 trillion would be financed by higher taxes on wealthy Americans.

-

The Build Back Better proposal would levy a tax surcharge on Americans who earn more than $10 million, invest in more IRS enforcement and raise taxes for some business owners.

-

It’s unclear whether the plan has the full backing of Democrats in the House and Senate.

Thursdays big news was the release of a $1.75 trillion social and climate spending bill. More than half of the bill would be financed by tax reform aimed at wealthy Americans.

Millionaire and billionaire surtax

Millionaire and billionaire surtax

A 5% surtax rate on income more than $10 million and and additional 3% surtax rate on income above $25 million would be in effect. This surtax is estimated to raise $230 billion over the next 10 years and would go into effect for tax years beginning January 1, 2022. As of 2018, there were 22,112 tax returns reporting income of more than $10 million.

“I don’t want to punish anyone’s success; I’m a capitalist,” President Biden said in a speech Thursday. “All I’m asking is, pay your fair share.” He also reiterated that households earning less than $400,000 per year wouldn’t “have to pay a penny more” in federal taxes, and would likely get a tax cut from the proposal via the enhanced child tax credit. The top 1% evade more than $160 billion per year in taxes, according to the White House.

Although specifics are omitted, the bill seems to have abandoned many of the tax proposals made last month by the House Ways and Means Committee. For example, the framework doesn’t raise the top income tax rate or top rate on investment income (with exception to those subject to the proposed surtax). It also doesn’t impose required distributions from large retirement account or alter rules around estate and trust taxes.

Business income

There are two provisions in the Build Back Better framework related to business income.

One would apply a 3.8% Medicare surtax to all income from pass-through businesses and another would limit a tax break on business losses for the wealthy.

The reforms would raise $250 billion and $170 billion, respectively, over a decade, according to estimates.

Currently, the owners of most pass-through businesses are subject to a 3.8% self-employment tax or net investment income tax. (Such businesses, like sole proprietorships and partnerships, pass their earnings to owners’ individual tax returns.)

However, some profits (namely, those of S corporations) aren’t subject to the 3.8% net investment income tax, which was created by the Affordable Care Act to fund Medicare expansion. The proposal would close this loophole for wealthy business owners.

It would apply to single taxpayers with more than $400,000 in taxable income or married couples filing a joint return with more than $500,000 in taxable income.

The second proposal is also somewhat vague on business losses. But the House tax proposal last month, which contained a similar measure, may offer a clue; it would permanently disallow excess business losses (meaning, net tax deductions that exceed their business income).

This applies to businesses that aren’t structured as a corporation.

Both provisions would kick in after Dec. 31.

IRS enforcement

Democrats’ plan would give $79 billion in new funding to the IRS to help close the so-called tax gap.

Relative to other taxpayers, they get a bigger share of income from opaque sources, such as certain business arrangements that aren’t as readily subject to tax reporting or withholding, according to Watson.

The IRS would hire enforcement agents trained to pursue wealthy tax evaders, overhaul 1960s-era technology and invest in taxpayer services to help ordinary Americans, according to the White House.

It estimates these measures would raise $400 billion over 10 years — the single-biggest revenue raiser in the proposal.

However, some question how lawmakers arrived at that revenue figure. The Treasury Department estimated last month that an $80 billion IRS investment would generate $320 billion in revenue over a decade.

How to Spot a Fake IRS Letter

The IRS is still sending out letters related to 2020 tax returns and you might be wondering if the letter you’ve received is legitimate and not a scam. The short answer is to verify directly with the IRS if the notice is requesting personal information or a payment for back taxes, but there’s also other signs that the letter you received isn’t really from the IRS. Here’s how you can spot a fake IRS letter.

What a real IRS will look like

An IRS envelope will include the IRS logo and the letter will have your tax ID number, and either a notice number (CP) or letter number (LTR) on either the top or bottom right-hand corner of the page. The letter will also include your rights as a taxpayer (something a scammer is unlikely to include). The letter will be sent to you for a few reasons:

- You have a balance due.

- You are due a larger or smaller refund.

- The IRS has a question about your tax return.

- The IRS needs to verify your identity.

- The IRS needs additional information from you.

- The IRS has changed your tax return.

- The IRS is notifying you of delays in processing your return.

A real IRS letter will never demand immediate payment or otherwise pressure you into giving out your personal information. If you are asked to pay back taxes, you will always be given steps to appeal your payment first. You’ll never be asked to make payments directly to the “IRS”—instead, payments will always be made to “United State Treasury”, which you can do by visiting www.irs.gov (and if the letter mentions gift cards? That’s a BIG RED FLAG, that’s a scam!).

When in doubt, verify with the IRS directly

Since IRS logos and letters can be faked easily, if you have any doubts that the letter is real, you can verify your account status by reviewing your tax account on the IRS website. Once you have reviewed your account and have determined that there is no balance due, you can report the fake IRS notice to the Treasury Inspector General of Tax Administration and with the IRS directly at phishing@irs.gov.

If you need help with your tax problems or have any questions, please reach out to our office at (207) 888-8800.

IRS stimulus check update: No, those recovery rebate credit error letters are not a scam

Over the last few weeks, an untold number of taxpayers have been confused by the arrival of not one but two letters from the Internal Revenue Service.

The first letter (CP11, CP12, or CP13) notified taxpayers that the IRS had made changes to their tax returns. Because of these changes, the taxpayer either owes money, is due a refund (or their refund amount changed), or now has a balance of zero.

So far, so good, right?

However, the confusion for many began with the arrival of a second notice (letter 6470), which referenced the first letter, notified recipients they had a right to appeal the first letter, and then apologized for not mentioning the appeal part the first time around. These second letters began arriving in people’s mailboxes recently, leading many taxpayers to speculate on social media and in Facebook groups whether they might be a scam.

They’re not a scam. The IRS had previously sent out about 5 million faulty “math error notices” that neglected to inform taxpayers of their right to appeal. Specifically, these notices were sent to people who claimed the recovery rebate credit—that’s the credit that lets you claim your stimulus checks if you were eligible but never received one. In the vast majority of cases, the math error notices were likely informing people that they weren’t eligible for a recovery rebate that they’d tried to claim, or that the rebate amount would be smaller.

But because the math error notices didn’t inform taxpayers of their full legal rights, the IRS had to basically eat crow and resend letters to every single one of those people, notifying them of their right to appeal, and apologizing for the omission. That’s what letter 6470 is all about.

It’s important to note, however, that the original math error notices were not invalidated because of the omission. In other words, if you truly did make a miscalculation on your tax return—and you’re not actually eligible for a recovery rebate credit—responding to letter 6470 isn’t going to make a difference. In fact, the letter clearly states, “If you agree with the changes we made, you don’t need to take further action.”

If you’ve double checked your math and still believe you’re entitled to the credit, you have to appeal within 60 days, but you will very likely have to provide documentation to prove your eligibility. The best thing to do is call the number provided on the letter and start there. If you are not able resolve this issue, please contact our office at (207) 888-8800.

IRS would track all bank transactions over $600 under Biden's proposed plan

The Biden administration has made clear its plan to beef up IRS auditing by expanding the agency’s funding and power. Biden’s latest proposal would require banks to turn over to the Internal Revenue Service bank account information for all accounts holding more than $600.

This major component of President Joe Biden’s plan to raise revenue to pay for his trillions of dollars in new federal spending is now under fire from trade associations across the country.

In a sharp rejection of the proposal, more than 40 trade associations, some of which represent entire industries or economic sectors, signed a letter to U.S. House Speaker Nancy Pelosi, D-Calif., and Minority Leader Kevin McCarthy, R-Calif., raising the alarm about the plan.

The letter, which includes the support of several banking coalitions, calls on Congress to reject that requirement, saying it violates customer privacy and would create an incredibly expensive and elaborate reporting requirement for the banks.

“While the stated goal of this vast data collection is to uncover tax dodging by the wealthy, this proposal is not remotely targeted to that purpose or that population,” the letter said. “In addition to the significant privacy concerns, it would create tremendous liability for all affected parties by requiring the collection of financial information for nearly every American without proper explanation of how the IRS will store, protect, and use this enormous trove of personal financial information. We believe that this program is costly for all parties, not fit for purpose, and loaded with potential for unintended and serious negative consequences.”

The groups argue it would target "almost every American" and question whether the IRS could keep that information secure from hackers and bad actors.

“The undersigned associations representing a cross-section of financial and business interests write to express our strong opposition to a proposal under consideration as part of the reconciliation package that would establish an expansive new tax information reporting regime that would directly impact almost every American and small business with an account at a financial institution," the letter said. "This proposal would create significant operational and reputational challenges for financial institutions, increase tax preparation costs for individuals and small businesses, and create serious financial privacy concerns. We urge members to oppose any efforts to advance this ill-advised new reporting regime."

Some reports indicate that Democrats hope to raise the $600 threshold, but that has not yet materialized.

Biden proposed giving an extra $80 billion to the IRS earlier this year for auditing, saying the agency would more than make back those funds. House Democrats’ have so far indicated they plan to fulfill that request.

“There’s a 99 percent compliance rate on wages – because wage earners get their earnings reported to the IRS,” a fact sheet says that was handed out by the White House to lawmakers to sell them on the plan. “But the super wealthy who get their income from unreported sources are able to hide their income and avoid paying the tax they owe. In fact, each year the top 1 percent chooses not to pay more than $160 billion in taxes.”

Republicans on the House Ways and Means Committee have scheduled a virtual roundtable Wednesday entitled, “Weaponization of the IRS: A Sordid History and the Need for Taxpayer Protections” to discuss these concerns.

“The meeting will highlight the efforts of congressional Democrats to nearly double the size of the IRS with a massive funding increase while doing nothing to address the weaponization of the IRS, including the massive, criminal leak of taxpayer information to ProPublica in June of this year,” Texas Republican Rep. Kevin Brady’s office said.

This isn’t the only business community criticism to be levied at the $3.5 trillion bill in recent days.

The U.S. Chamber of Commerce officially condemed the bill this week, calling it an “existential threat” to the economy.

“This reconciliation bill is effectively 100 bills in one representing every big government idea that’s never been able to pass in Congress,” U.S. Chamber of Commerce President and CEO Suzanne Clark said. “The bill is an existential threat to America’s fragile economic recovery and future prosperity. We will not find durable or practical solutions in one massive bill that is equivalent to more than twice the combined budgets of all 50 states. The success of the bipartisan infrastructure negotiations provides a much better model for how Congress should proceed in addressing America’s problems.”

A Paycheck in Crypto? There Might Be Some Unexpected Headaches

Cryptocurrencies (eg. Bitcoin, Dogecoin, etc) have been on an upswing after months of declines, giving some credence to those who say digital currencies are resilient and on the verge of becoming more widely accepted.

While it's too difficult to predict anything when it comes to cryptocurrencies, more people are getting paid or wanting to be paid, in this method. They cite the ease and transparency of payments in digital currencies, especially when employers and employees aren't based in the same country.

There are some important considerations to keep in mind. Aside from the volatility, a misstep could result in not getting compensated correctly or creating potential trouble with the Internal Revenue Service and state agencies.

U.S. employers may be resistant to compensation in cryptocurrencies at the outset. It's a lot more work for them when withholding some of the income that's required to pay FICA (Social Security and Medicare) taxes. If an employee is paid in digital coins, employers have to deal with additional accounting and the converting of some of that income into U.S. dollars to pay those federal taxes.

Some may find that employers would prefer to classify them as contractors rather than employees so they can push the withholding burden onto workers, who would then be considered self-employed.

For contractors, it's imperative they request a 1099-NEC form, which is what's used to report income from the companies they work for. They should ask for details listing when individual units of cryptocurrency were received and the price for each. Doing so will help those receiving this form of compensation to calculate their tax liabilities accurately.

Note that non-employees are responsible for paying the self-employment tax (a 15.3% tax that goes toward Social Security and Medicare). Software such as cryptotrader.tax and bitcoin.tax can help with record-keeping.

Recipients owe ordinary income tax on whatever the fair market value of the coins is when they receive them. They'll also face capital gains taxes when they sell or swap the coins for other digital currencies. If it's within a year, they'll be subject to short-term capital gains tax rates (which are generally the same as ordinary income tax rates), or if it's longer then they'll face long-term capital gains tax rates (0%, 15% or 20%, depending on their tax bracket).

Since tax isn't automatically withheld by employers for contractors, those workers are usually advised to make estimated tax payments each quarter rather than face a big bill when they file their returns. With cryptocurrencies, it can be difficult to estimate what's owed, so self-employed workers should consider paying 100% (or 110%, if they earn more than $150,000) of what they paid the prior year. This will help avoid any underpayment penalties when they square up at the end of the tax year.

Some cryptocurrency devotees may be reluctant to sell any holdings to make those estimated payments and would rather face the underpayment penalty. That could be a red flag to the IRS to open up an audit.

It's wise to hash out with an employer ahead of time when the value of cryptocurrency compensation is being calculated. Is it when a work period ends? Or when payment is due?

Given the volatility of the cryptocurrency market, a few days can make a big difference in what's paid out. It's also helpful to agree on how to compensate for things like paid vacation days. Whatever it is, workers need to make sure it's clearly stated and not just at the discretion of the employer.

Those working for crypto-focused companies may be given compensation in the form of private tokens that aren't traded as easily as Bitcoin, Ethereum or Litecoin. Figuring out the fair market value of those tokens can be tricky when calculating tax owed, but token holders shouldn't use that as a free pass to ignore reporting requirements.

In addition, those coins may be granted as bonus compensation that vests, similar to stock options, but there's an important distinction. With stock options, the recipient has the ability to recognize some of the income sooner to pay less tax in the future. It's likely that the IRS wouldn't allow a private token-holder to make the same election.

The smartest approach for those interested in getting paid in digital currencies is usually a hybrid, with some compensation in cryptocurrencies and some in dollars. For those more bullish on the future of digital currencies, it's better to just invest in them outright than gamble with your paycheck.