IRS warns: Deferred payroll taxes due in December

The Internal Revenue Service is sending notices to taxpayers who deferred their Social Security taxes last year, reminding them that half the taxes will be due by the end of this year.

In an email to payroll professionals Friday, the IRS said that it’s sending informational-only CP256V Notices to self-employed individuals and household employers who chose to defer paying some Social Security taxes under the CARES Act in October and November. The notice reminds them that the first installment of deferred Social Security taxes will be due by the end of December and the remainder by the end of next year.

In an email to payroll professionals Friday, the IRS said that it’s sending informational-only CP256V Notices to self-employed individuals and household employers who chose to defer paying some Social Security taxes under the CARES Act in October and November. The notice reminds them that the first installment of deferred Social Security taxes will be due by the end of December and the remainder by the end of next year.

The payroll tax deferral helped taxpayers who found they desperately needed funds to pay their regular expenses during the first year of the pandemic. However, many tax professionals advised their clients that the taxes would eventually come due. The payroll tax relief in the CARES Act for employers differed from the payroll tax holiday that former President Trump issued by executive order in August of last year for employees, which required repayment of the deferred taxes by the end of April 2021. Federal government employees and members of the military were automatically subject to that payroll tax holiday, but most taxpayers and companies avoided opting for it last year, knowing the taxes would eventually have to be paid.

“The CARES Act allowed these types of taxpayers to defer the payment of certain Social Security taxes on their Form 1040 for tax year 2020 over the next two years,” said the IRS. “Half of the deferred Social Security tax is due by Dec. 31, 2021, and the remainder is due by Dec. 31, 2022.”

What you need to do

- Pay your current installment amount by the due date shown on the notice. Note: the notice may not reflect recent payments, but they will still be recorded correctly on your account.

- Review your tax return for the tax period in which you deferred Social Security taxes and subtract any payments you’ve made. Compare that figure with the amounts shown on your notice. If you discover an error, please contact us at the telephone number shown on the notice.

What you need to know

- The first installment amount, due December 31, 2021, is half the employer’s share of Social Security taxes you could have deferred (which includes any amount of the employee’s share of Social Security taxes deferred under Notice 2020-65, as modified by Notice 2021-11) minus all deposits and payments we’ve received. For more information, please review Q&A 18 at IRS.gov/etd.

- The second installment, due December 31, 2022, is the remaining unpaid deferred taxes.

Frequently asked questions

Do I have to reply to this notice?

No, this is a courtesy notice for your information only. No response is needed.

How do I make my repayment?

You can make the deferral payments through the Electronic Federal Tax Payment System (EFTPS), by credit or debit card, or with a check or money order. Note: you must make these payments separate from other tax payments to ensure they’re applied to the deferred payroll tax balance. IRS systems won’t recognize the payment if it’s with other tax payments or sent as a deposit.

To make the deferred payment using EFTPS, select deferral payment and change the date to the applicable tax period for the payment.

If the employee no longer works for the organization, you must repay the entire deferred amount of the employee’s portion of Social Security tax then collect the employee’s portion using your own recovery methods.

How do I make a payment for a deferred amount on an aggregate return?

Third-party payers (such as an Internal Revenue Code Section 3504 agent, a certified professional employer organization, a non-certified professional employer organization, or other agents designated with Form 2678, Employer/Payer Appointment of Agent) file aggregate returns to show the employer’s deferred tax.

Employers should coordinate with their third-party payer to pay deferred taxes owed by the December 31, 2021, and December 31, 2022, due dates. This helps ensure the third party properly records the payment and the correct employer identification number (EIN) and tax period are noted with the payment so the IRS can apply it properly.

Employers should continue coordinating with their third-party payer to ensure payments are applied under the third party’s EIN (unless the employer receives an IRS notification stating the unpaid deferral amount has been moved to their EIN).

What if I cannot pay my deferred taxes?

You may be eligible for a payment plan or other payment options. Note: if the IRS doesn’t receive your payment by the applicable due dates, the deferred taxes may be subject to Failure to Deposit penalties.

When should I repay deferred taxes?

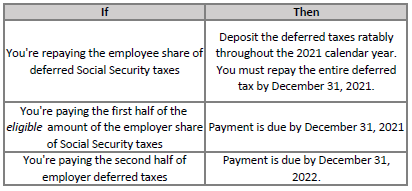

The following table shows the schedule for repayment:

Penalties and interest begin accruing on the day payments are due if they aren’t timely paid.

How do third-party payers report unpaid deferred amounts from aggregate returns?

Employers are solely responsible for payment of the deferred taxes they requested for any wages paid by the third-party payer. If the third-party payer filed an aggregate return and receives a balance due notice for the employer’s unpaid portion of deferred Social Security tax, the third-party may notify the IRS by eFaxing the following information with a coversheet to 844-255-1856:

- Copy of the Schedule R (Form 941 or 943) for relevant tax periods

- Client (common law employer) name, EIN, and current address

- Total deferred amount per tax period

- Unpaid part of the deferred amount, per tax period

- List of deferral payments by client or by the third-party payer on behalf of client(dates and amounts), per tax period

- If applicable, date client separated from aggregate filer

Let’s find your way to tax and accounting peace of mind

Let us be part of your journey towards success.