IRS Launches New ERC Voluntary Disclosure Program

The Internal Revenue Service (IRS) has introduced a groundbreaking initiative to address questionable Employee Retention Credit (ERC) claims. This newly unveiled Voluntary Disclosure Program aims to assist businesses that received ERC funds erroneously. In this comprehensive guide, we will delve into the details of this program and explore its significance in the ongoing battle against misleading ERC claims.

Understanding the ERC Voluntary Disclosure Program

In its ongoing efforts to curb deceptive ERC claims, the IRS has rolled out a voluntary disclosure program that offers businesses the opportunity to rectify their misfiled claims. This initiative, which has been in development for several months, is a pivotal component of the IRS's broader strategy to combat aggressive marketing tactics that led some employers astray. The ERC Voluntary Disclosure Program is set to run until March 22, 2024, and includes provisions allowing participants to repay only 80% of their received ERC claim.

Previous Actions and Ongoing Initiatives

The IRS's commitment to addressing erroneous ERC claims is evident in its recent actions. This includes sending over 20,000 denial letters to ERC claimants, introducing a withdrawal program for pending ERC claims, and imposing a moratorium on new ERC claims processing. These initiatives underline the IRS's dedication to ensuring the proper utilization of the ERC.

Eligibility for the ERC Voluntary Disclosure Program

Various ERC recipients are eligible to participate in this program, including employers who received ERC for a specific tax period but were not entitled to it. Eligibility criteria include not being under criminal investigation or IRS audit, not having received a demand for ERC repayment, and not having information from a third party indicating noncompliance.

Application Process

Employers interested in participating in the ERC Voluntary Disclosure Program must complete and submit Form 15434, "Application for Employee Retention Credit Voluntary Disclosure Program," available on IRS.gov. The form should be submitted using the IRS Document Upload Tool. While participants are expected to repay their full ERC amount minus the 20% reduction allowed through the program, installment agreements are available under certain conditions.

Special Considerations for Payroll Outsourcing

Employers who outsource their payroll responsibilities to a third party must follow a specific process. In this case, the third party, not the employer, is responsible for filing Form 15434. Detailed information can be found in the form and its accompanying instructions.

Additional Resources for Applicants

To assist employers in understanding the terms of the program, the IRS has provided a set of Frequently Asked Questions (FAQs). Upon applying to the program, an IRS employee will contact the employer to review the application and address any questions.

Next Steps after Approval

Upon approval, the IRS will send a closing agreement to the employer. Payment of 80% of the received ERC can be made online or by phone using the Electronic Federal Tax Payment System (EFTPS). Employers unable to make full payment can explore installment agreements, although penalties and interest may apply.

Why 80% Repayment?

The IRS chose the 80% repayment rate to address situations where ERC promoters charged a percentage fee upfront, resulting in recipients not receiving the full claimed amount.

Expanding Efforts and Future Updates

The ERC Voluntary Disclosure Program represents the latest step in the IRS's multifaceted approach to combat ERC fraud. The IRS is committed to intensifying audits and criminal investigations, with hundreds of criminal cases and thousands of ERC claims under scrutiny. The agency will provide updates on the moratorium in the coming year.

Reminder: Withdrawal Option for Pending ERC Claims

Employers with pending ERC claims still have the opportunity to withdraw their submissions. This special withdrawal process allows them to avoid future repayment, interest, and penalties. The IRS encourages pending applicants to review their claims, especially in light of the new Voluntary Disclosure Program.

Conclusion

The IRS's introduction of the ERC Voluntary Disclosure Program is a significant development in the ongoing efforts to ensure the proper use of ERC funds. Employers who may have inadvertently filed erroneous claims now have an opportunity to correct their filings with reduced financial implications. This initiative, coupled with the IRS's continued vigilance, reflects the agency's dedication to protecting businesses and individuals from deceptive ERC practices.

For more information or if you have any questions about your specific situation, please reach out for a consultation. www.heritagetaxcompany.com

SEP Retirement Plans Explained: Maximizing Benefits for Small Businesses and Self-Employed

Are you a business owner or an employee looking for an effective retirement plan? The Simplified Employee Pension (SEP) plan might be just what you need. This article will dive into the details of SEP plans, showcasing why they are a popular choice for various businesses.

What is a SEP Plan?

A SEP plan is a workplace retirement plan tailored for employers, including sole proprietors, partnerships, LLCs, corporations, non-profit organizations, and government entities. It's designed to provide a straightforward method for employers to contribute to their own and their employees' retirement savings.

Key Features of SEP Plans

- Flexible Contributions: Employers make all contributions, which are tax-deductible and grow tax-deferred until distribution. Remarkably, there's no set requirement for annual contributions; employers can decide each year how much to contribute, from zero to 25% of compensation.

- Contribution Limits: The contribution limit is the lesser of 25% of compensation or specific annual caps ($66,000 in 2023 and $69,000 in 2024). The compensation basis for SEP contributions also has a cap ($330,000 in 2023 and $345,000 in 2024).

- Eligibility Criteria: Eligibility can vary. Common requirements include being at least 21 years old, having worked for the employer during three of the past five years, and earning at least $750 in the current year. Employers can exclude certain groups under specific conditions but have the flexibility to reduce or eliminate these requirements.

- Immediate Vesting: In a SEP plan, vesting is immediate. This means that employees have full ownership of the contributions as soon as they're made.

- Deadlines: Employers must establish and fund the SEP IRA by their tax-filing deadline, including extensions.

- Cost-Effective: SEP plans are an economical option for workplace retirement plans, not requiring special IRS filings like form 5500.

Who Benefits from SEP Plans?

SEP plans are particularly advantageous for small businesses and self-employed individuals due to their low cost and administrative simplicity. They also offer flexibility for employers who may not be able to commit to consistent annual contributions.

How to Set Up a SEP Plan

Setting up a SEP plan is relatively straightforward. You'll need to execute a formal written agreement using IRS Form 5305-SEP, provide employees with information about the plan, and set up an IRA account for each participant.

Conclusion

SEP plans offer a flexible, cost-effective way for employers to contribute to their and their employees' retirement savings. With their easy setup and administration, SEP plans are an excellent choice for small businesses and self-employed individuals looking to offer retirement benefits.

For more detailed guidance on SEP plans, schedule a time to cat with one of our experts at Heritage Tax Company. You can schedule a consultation here or learn more about us at www.heritagetaxcompany.com.

Do You Need to File 1099-NEC Forms? A Quick Guide

Are you feeling puzzled about whether you need to file 1099-NEC forms this tax season? You're not alone. The IRS has specific rules about who should file these forms, and it's primarily a business filing requirement. If you're an individual taxpayer, it's essential to understand that 1099-NEC forms are typically related to business activities, so you might not need to worry about them if you're not running a business. However, if you're still unsure, let's dive into the details to determine whether you should be filing these forms.

Who Needs to File 1099-NEC Forms?

1099-NEC forms, also known as Nonemployee Compensation forms, are typically used by businesses to report payments made to non-employees or independent contractors. If you operate a business, you might need to file these forms if you meet the following criteria:

1. You Paid a Non-Employee Over $600:

- If your business paid an individual or unincorporated business entity (like a sole proprietorship or partnership) $600 or more during the tax year for services provided, you must file a 1099-NEC form.

2. Non-Employee Workers:

- This form is mainly used to report payments made to freelancers, contractors, consultants, and other non-employee workers. It doesn't apply to payments made to regular employees.

3. Payment Types:

- Payments reported on 1099-NEC forms typically include compensation for services, fees, commissions, prizes, awards, and more. It's essential to report all payments made to non-employees for services rendered.

4. Business Expenses:

- If these payments are considered ordinary and necessary business expenses, you should report them on the 1099-NEC.

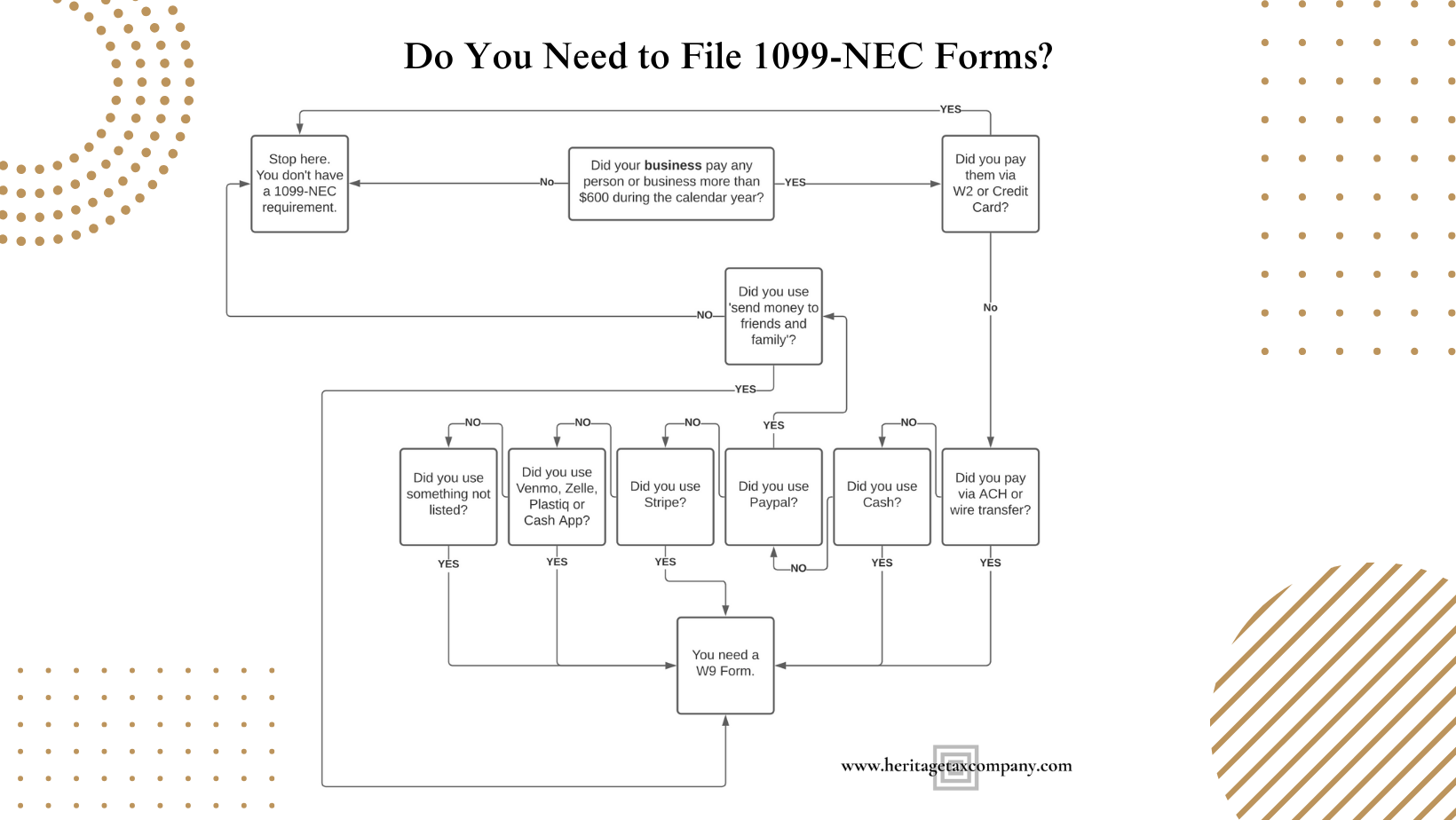

Flowchart: Do You Need to File 1099-NEC Forms?

To simplify the decision-making process, we've created a flowchart to help you determine if you need to file 1099-NEC forms:

Additional Considerations:

- Deadline: If you determine that you need to file 1099-NEC forms, be aware of the filing deadline. The forms must be provided to recipients by January 31st and submitted to the IRS by February 28th (or March 31st if filed electronically).

- Penalties: Failing to file 1099-NEC forms when required can result in penalties. It's essential to meet the deadlines and provide accurate information.

Remember, this flowchart provides a general guideline. Tax laws and regulations can change, so it's advisable to consult with a tax professional or visit the IRS website for the most up-to-date information. Properly filing 1099-NEC forms ensures compliance with tax regulations and helps you avoid potential penalties.

If you need help or would like to engage with us for this filing service, please contact us here.

SCAM ALERT: Defending Against the Alert 1019 Scam: What You Need to Know

The new Alert 1019 scam is a treacherous scheme that targets individuals across North America, with the sinister intent of purloining personal information and money. In this comprehensive guide, we aim to illuminate every facet of the Alert 1019 scam, from its modus operandi to warning signals and expert advice to safeguard yourself.

Understanding the Scam's Mechanics

The Alert 1019 scam typically commences with unsolicited communication, manifesting as phone calls, emails, or text messages masquerading as government agencies. These malevolent actors create an aura of urgency, asserting that you owe money or are embroiled in legal predicaments. They then coerce you into contacting them or visiting a fabricated website to ostensibly resolve the concocted issue. In reality, their ulterior motive is to abscond with your personal data and hard-earned money.

Identifying the Telltale Signs

Recognizing the Alert 1019 scam hinges on being attuned to certain unmistakable red flags:

- Unsolicited Communication: You receive messages or calls from unfamiliar or unverified sources.

- Urgent Threats: Scammers employ high-pressure tactics, demanding immediate action.

- Unusual Payment Requests: They insist on payment via wire transfers, gift cards, or cryptocurrency, methods that are notoriously challenging to trace.

- Solicitation of Sensitive Data: Be wary if you are asked to divulge your Social Security Number (SSN) or banking details.

Unmasking the Culprits

The orchestration of the Alert 1019 scam is attributed to criminal networks operating offshore, often from locations such as India or Nigeria. These perpetrators exploit Voice over Internet Protocol (VoIP) technology to obscure their identities and employ cunning strategies to simultaneously target thousands of victims.

Vulnerable Groups at Risk

The Alert 1019 scam specializes in preying on susceptible demographics, including:

- Elderly Individuals: Those less acquainted with contemporary scam tactics.

- Recent Immigrants: Individuals unfamiliar with how US government agencies and law enforcement typically communicate.

- Financially Struggling Individuals: Those grappling with financial difficulties, who are susceptible to threats of legal ramifications.

- Data Breach Victims: Individuals whose personal information has been previously compromised.

- Previous Scam Victims: Individuals who have fallen victim to scams in the past and may be listed on a "suckers list" among con artists.

Expert Strategies for Self-Protection

Shielding yourself from the Alert 1019 scam necessitates adopting these expert-recommended strategies:

- Block Unknown Numbers: Employ call screening and blocking tools to divert unfamiliar calls to voicemail, deterring scam robocalls.

- Avoid Impulsive Actions: Always verify the legitimacy of calls or messages before disclosing any personal or financial information.

- Government Communication Norms: Recognize that government entities primarily employ postal mail, not phone calls, emails, or text messages, to communicate official matters.

- Beware of Coercion: Scammers may employ threats and intimidation; however, legitimate entities do not resort to such tactics.

- Seek Assistance: If targeted, seek support from trusted sources, such as the FTC or legal counsel.

Responding to a Scam Call

In the event of receiving a suspicious call:

- Hang Up: Do not engage or provide information.

- Report to the FTC: Swiftly report the call to the Federal Trade Commission.

- Notify Your Carrier: Inform your phone carrier.

- Erase Voicemails: Delete any voicemails to prevent accidental redialing.

- Text Scams: For text-based scams, forward the message to 7726 (SPAM).

Dealing with Payment to Scammers

If you've already fallen victim to the scam:

- Report It: Immediately file a report with the FTC and local law enforcement.

- Contact Your Bank: Notify your bank or financial institution.

- IRS Involvement: If the scam pertains to taxes, contact the IRS.

- Gather Evidence: Collect all relevant records and evidence, including bank statements and communication logs.

- Dispute Unauthorized Charges: Collaborate with your bank and credit card issuer to initiate chargebacks and file fraud investigations.

- Legal Consultation: Consider consulting an attorney for legal action against the scammers and entities involved in facilitating the fraud.

Shutting Down Scam Numbers and Websites

To combat the Alert 1019 scam, here's how you can contribute:

- Report Numbers: Report scam numbers to NoMorobo.

- File Complaints: File telephone spam complaints with the FTC and Federal Communications Commission (FCC).

- Carrier Intervention: Request that your phone carrier blocks fraudulent numbers.

- Text Scams: For text-based scams, forward the message to 7726.

- Encourage Reporting: Encourage others to report and block scam numbers to protect a wider audience.

Law Enforcement Response

Authorities are actively addressing the Alert 1019 scam by:

- Raising Public Awareness: Launching scam alerts and awareness campaigns to educate the public on recognizing and avoiding scams.

- Network Disruption: Collaborating with telecommunications regulators to trace spoofed numbers and request blocks on fraudulent calls.

- Undercover Operations: Conducting covert investigations to infiltrate and dismantle criminal call centers.

- Legal Reform: Strengthening legislation to better combat phone and online scams.

Recovering Finances and Identity

If you've fallen victim, take these steps:

- Fraud Alerts: Place fraud alerts on your credit reports to protect against identity theft.

- Password Changes: Change passwords for affected accounts and enable two-factor authentication where possible.

- Account Monitoring: Continuously monitor your financial accounts for unauthorized activity.

- Legal Assistance: Consider seeking legal counsel to explore avenues for recovering lost finances and holding scammers accountable.

Conclusion: Outsmart the Scammers

In the battle against the Alert 1019 scam, knowledge and vigilance are your most potent weapons. By staying informed, recognizing the warning signs, and promptly reporting scams, we can collectively thwart these fraudsters. Share this guide widely to bolster awareness and help protect others from falling victim to these scams. Together, we can work towards dismantling these criminal networks for good.

Analyzing the Tax Implications of the Twelve Days of Christmas

The gifts from the "Twelve Days of Christmas" are far from practical - it's not every day you find a use for leaping lords. But, have you ever thought about their tax implications? A tax, after all, is a compulsory financial charge imposed by local, state, or national authorities on individuals or businesses to fund various public expenditures and services. The following are twelve historical tax scenarios.

Twelve Drummers Drumming: A Unique Tax Collection Method in India

In India, drummers serve a unique purpose beyond entertainment in the realm of tax collection. Rather than relating to the entertainment tax, these drummers are instrumental in tax enforcement strategies. Local authorities often employ drum bands to visit businesses that have fallen behind on their tax payments. This method, which aims to prompt payment through public attention, has proven effective. For instance, in Mumbai, tax collections increased by 20 percent following the deployment of drummers. Therefore, the presence of twelve drummers drumming might raise the question of not just the cost of their service, but the extent of the tax debt that necessitated their appearance. When someone in the Indian city of Thane doesn't pay their taxes, the government sends an army of drummers to their door to shame them. According to the Wall Street Journal, the strategy works very well: When Mumbai started sending drummers after tax dodgers, tax revenue went up 20%.

Eleven Pipers Piping and the Sales Tax Dilemma

Imagine you're planning to attend a holiday woodwind concert, but you're unsure if your ticket will be taxed. Sales tax, typically applied to retail sales of goods and services, varies in its application. Many jurisdictions exempt necessities like groceries to lower overall rates, and avoid taxing business-to-business transactions to prevent tax pyramiding. The tax status of concert tickets, however, is less straightforward. In certain areas, concerts might be classified as educational and thus exempt from sales tax. Conversely, the Wisconsin Supreme Court ruled in the case of Milwaukee Symphony Orchestra, Inc. v. Wisconsin Department of Revenue that orchestra performances are primarily entertainment, not educational, and are therefore taxable. This ruling suggests that in some states, enjoying the melodies of eleven pipers might come with an additional tax cost.

Ten Lords A-Leaping: A Quirk in Nevada's Live Entertainment Tax

It's amusing to imagine nobility engaging in acrobatics for profit – a scenario perhaps fitting for 'Lords of Misrule'. Interestingly, in Nevada's previous Live Entertainment Tax system, such an act might have found a tax loophole. This tax, set at 10%, wasn't applied to performances by employees who weren't regularly entertainers, leaving room for interpretation on the entertainment value of leaping lords. Additionally, this tax system had its peculiarities: live music was taxable, but audience members too far to enjoy it properly were exempt, and roaming performers singing among the audience were not taxed. This set of rules creates a scenario almost as whimsical as having aristocrats performing for an audience.

Nine Ladies Dancing: From Pagan Festivals to Medieval Plays

The 'nine ladies dancing' in the famous Christmas song likely refers to carolers performing a 'carol,' a circular dance with roots in pagan festivals. These dances evolved into integral parts of medieval mystery plays, which depicted biblical stories including the life and teachings of Christ, through a blend of dialogue, song, and dance. An example of such a play is the Coventry Mystery Plays, known for the renowned Coventry Carol. In these plays, different guilds, like shipbuilders and goldsmiths in the York Plays, sponsored various biblical scenes.

These guilds formed primarily as a response to the arbitrary tax demands of feudal lords, who wielded extensive power over trade within their domains. They represented collective bargaining units for craftsmen, negotiating tax responsibilities with their lords. Interestingly, while women participated in the original pagan carols, by the time of the mystery plays, men had taken over all female roles.

Eight Maids A-Milking: Dairy Cattle and Tax Favoritism

The 'eight maids a-milking' bring to light an interesting aspect of tax codes concerning dairy cattle. Consider a situation in Alberta, Canada, where beef cattle ranchers contended with a local government over a $3 per head tax, a fixed charge applied uniformly to each head of cattle. However, this tax did not apply to dairy cattle, showing a clear preference in the tax system. A similar scenario exists in Virginia, where cattle handlers are taxed 25 cents per head sold, with an exemption for dairy cows returning to farms for milk production. This distinction in tax treatment highlights the agricultural sector's nuanced relationship with tax laws, often favoring dairy over beef cattle, much to the chagrin of those hypothetical maids engaged in dairy farming.

Seven Swans A-Swimming: Territorial Nature and Property Tax Considerations

The imagery of 'seven swans a-swimming' conjures a serene picture, yet it also highlights the territorial nature of swans, particularly evident in nesting pairs. To accommodate seven swans swimming harmoniously, a considerably large lake would be necessary. This requirement for ample space introduces a significant aspect of property ownership: the higher property taxes often associated with larger and more valuable properties, such as those with substantial lakes.

Owning such a property could lead to substantial tax assessments, reflecting the value and size of the land. This becomes especially pertinent if the property includes natural features like large lakes that enhance its aesthetic and monetary value. However, the financial burden of these taxes might become a point of concern in the event of unexpected market downturns or 'black swan' events - unforeseen occurrences that can dramatically impact financial markets and personal investments. In such scenarios, the cost of maintaining such a property, including the tax obligations, could become a significant financial strain, turning what was once a tranquil setting into a source of economic pressure.

Six Geese A-Laying: Wildlife Tax Exemptions and Unique Tax Laws

In the context of the 'Six Geese A-Laying,' an interesting question arises about their status as wild geese, especially in relation to tax laws like Texas’s wildlife tax exemption. To be eligible for this exemption, landowners must actively engage in at least three out of seven habitat management activities, such as controlling the habitat, managing predators, and providing shelter or supplemental food for wildlife. This rigorous requirement means that unless the geese are exceptionally valuable (akin to the fabled goose that lays golden eggs), the cost and effort involved in qualifying for the exemption may outweigh the financial benefits.

In the context of the 'Six Geese A-Laying,' an interesting question arises about their status as wild geese, especially in relation to tax laws like Texas’s wildlife tax exemption. To be eligible for this exemption, landowners must actively engage in at least three out of seven habitat management activities, such as controlling the habitat, managing predators, and providing shelter or supplemental food for wildlife. This rigorous requirement means that unless the geese are exceptionally valuable (akin to the fabled goose that lays golden eggs), the cost and effort involved in qualifying for the exemption may outweigh the financial benefits.

Moreover, the tax landscape saw an interesting development with a 2014 tax bill proposing to extend bonus depreciation benefits. Bonus depreciation is a significant tax incentive, allowing businesses to deduct a greater portion of investments in new or improved technology, equipment, or buildings in the first year. This provision aims to mitigate a bias in the tax code and encourages more corporate investment, which can lead to increased worker productivity, higher wages, and job creation. Notably, this bill proposed to apply this incentive to capital investments in fruits that grow on trees, but not those on bushes. This distinction would be particularly favorable if one were to believe the obscure medieval notion that a certain species of goose was, in fact, a fruit growing on trees. This quirky historical belief adds a layer of whimsy to the interpretation of tax laws and their impact on different types of assets, even those as unusual as tree-borne geese.

Five Gold Rings: A Tale of Luxury Taxes and Historical Misinterpretations

The 'five gold rings' from the classic Christmas song might bring to mind the U.S.'s brief foray into luxury taxation in 1991 when a 10 percent tax was levied on high-end goods, including jewelry over $10,000. However, this tax, faced with underwhelming revenue generation and adverse impacts on certain industries, was largely reversed by Congress in just two years, leaving only a similar tax on cars priced above $30,000, which was also eventually repealed. While some states continue to enforce their own luxury taxes, Major League Baseball has its version, imposing a 'luxury tax' on team payrolls exceeding set limits, though it's not an official government tax. Interestingly, teams may encounter dual luxury taxes: one on high payrolls and another on extravagant World Series rings. However, a historical twist suggests that the 'five gold rings' could actually be a reference to ring-necked pheasants, a bird historically prized by the elite and linked to the lore of Jason and the Argonauts. If this interpretation holds, it intriguingly shifts the focus of the first seven days of the Christmas song to a variety of birds.

Four 'Calling' Birds: Clarifying a Common Misunderstanding and Tax Implications

The phrase 'Four Calling Birds' from the classic Christmas carol is often misunderstood. The original lyric is actually 'Four Colly Birds,' with 'colly' meaning black, referring to blackbirds, which are a type of thrush. While these birds may not hold the same noble status as pheasants, they have a unique place in culinary history, often regarded as a delicacy. Historical references, like the famous nursery rhyme about blackbirds baked in a pie, highlight their use in traditional cuisine.

Given this culinary context, it's important to consider potential tax implications if you're in a region where these birds are served as part of a meal. Many jurisdictions impose a meals tax on prepared foods, which could include dishes featuring blackbirds. This tax varies from place to place and is typically applied at the point of sale in restaurants or other dining establishments. Therefore, if you're indulging in a dish that includes 'colly birds' or any other type of prepared bird, it would be wise to check if this meals tax applies in your area. This tax, often a small percentage of the meal cost, contributes to local revenue and can have implications for both consumers and businesses in the food service industry.

Three French Hens: A Linguistic Twist and Historical Anecdotes

The 'Three French Hens' in the renowned Christmas song might not be hens after all but could be a play on words pointing to roosters. This interpretation stems from the close resemblance between 'Gallia,' the Latin name for France, and the Latin word for rooster. This possible misinterpretation brings a twist to the traditional Christian holiday narrative, echoing the biblical moment where a rooster crowed three times during Jesus' betrayal, symbolically prefiguring the crucifixion.

Adding to the intrigue, there’s an interesting historical tale by Procopius, a historian, about the last emperor of the Western Roman Empire. Upon hearing from a eunuch that 'Rome had fallen,' the emperor initially thought he was being informed of the death of his beloved rooster, named Rome. His grief turned to relief when he discovered it was the city, not his prized rooster, that had been lost. This anecdote, while amusing, also touches upon the broader theme of misinterpretation, both linguistic and situational. Moreover, it subtly hints at the role excessive taxation may have played in the downfall of the Western Roman Empire, drawing a parallel to how misunderstandings and fiscal burdens can have profound impacts on history.

Two Turtle Doves: Symbolism in Nature and Tax Implications for Marriage

The 'Two Turtle Doves' in the classic Christmas song likely carry deeper symbolism, traditionally representing love and fidelity, as these birds are known for their strong pair bonds, often staying with their mates for life. This enduring partnership between turtle doves makes them an emblematic symbol of marriage and commitment in various cultures and lore, including the fascinating bird lore detailed in the Book of Saint Albans. Their portrayal in the song may also subtly reflect the poet's fascination with birds and their symbolic meanings.

However, on a more practical note, the symbol of marriage embodied by these doves also brings to mind the modern implications of marital status on taxation. In the realm of tax law, the concept of a 'marriage penalty' arises when married couples face a higher tax burden compared to what they would owe individually. This penalty often occurs in tax systems where the income brackets for joint filers are not double those for single filers, leading to a disproportionate increase in tax liability for couples with similar income levels. This tax issue, affecting both high- and low-income couples, contrasts with the romantic symbolism of the turtle doves, offering a grounded perspective on the financial realities that can accompany marriage.

Partridge in a Pear Tree: Exploring the Tree's Historical and Linguistic Significance

Shifting focus from the abundance of birds, the 'Partridge in a Pear Tree' from the famed Christmas carol brings us to the tree itself. This element draws attention to a historical episode in 1944 when the Soviet Union, in an effort to increase revenue, imposed a heavy tax on fruit trees. This tax burden led many struggling farmers to cut down their trees, a decision reflecting the harsh economic realities of the time. Nikita Khrushchev later remarked on this, highlighting how economic decisions often have unintended and unfavorable consequences.

Interestingly, the pear tree in the song might be a result of linguistic evolution. Some suggest that the original phrase was 'a partridge, une perdrix,' simply a repetition of 'a partridge' in French. Over time, this phrase may have transformed into the current 'in a pear tree' due to a common linguistic phenomenon known as a mondegreen, where misheard or misinterpreted phrases gain new meanings. This term originates from a misinterpretation in the Scottish ballad 'The Bonnie Earl o’ Moray,' where 'laid him on the green' was heard as 'Lady Mondegreen.' Thus, the pear tree, whether real or a result of linguistic misinterpretation, carries both historical and linguistic significance beyond its simple portrayal in the song.

One Final Note: Revisiting the True Meaning of the Twelve Days of Christmas

There's a common misconception in our society about the nature of the Twelve Days of Christmas, and it's not just about overlooking their potential tax implications. Contrary to popular belief, these twelve days are not a countdown leading up to Christmas Day; rather, they commence from it. Christmas Day marks the beginning of Christmastide or Twelvetide, a festive season that spans twelve days, concluding with the Twelfth Night, as famously referenced by Shakespeare. This night falls on the eve of the Epiphany, a significant Christian celebration that commemorates the revelation of God incarnate as Jesus Christ.

This period is traditionally a time of continued festivity and reflection, following the anticipation and celebration of Christmas Day itself. In light of this, if you're planning to embrace these traditions – say, by preparing a special Twelfth Night pie featuring those 'colly birds' or any other festive delicacies for your loved ones – there's no need to rush. The true spirit of the Twelve Days of Christmas offers ample opportunity to celebrate, reflect, and enjoy the company of those dear to you, all the way through to the grand finale on Twelfth Night. It's a time to savor the joy and warmth of the season, creating memories that extend well beyond December 25th.