IRS Reports Record $688 Billion Tax Gap in 2021 - Anticipate Increased Audits

In a record-breaking development, Americans collectively failed to pay an estimated $688 billion in taxes on their 2021 returns, according to the IRS. This striking figure has prompted the IRS to take "urgent" measures to enhance compliance, including increased audits targeting high-income individuals, businesses, and partnerships.

For the first time, the IRS is providing annual data on the tax gap, with plans to continue this reporting in the future. This eye-opening $688 billion estimate represents a significant increase of over $138 billion compared to the estimates for tax years 2017 to 2019.

One key strategy employed by the IRS to close this gap is ramping up audits on wealthy taxpayers. This initiative is a direct response to the funding boost provided by the Inflation Reduction Act (IRA). By focusing on higher earners who may be avoiding their tax obligations, the IRS aims to bridge the tax gap and generate additional revenue for federal programs, including the IRA's substantial $370 billion investment in green energy initiatives.

IRS Commissioner Danny Werfel emphasized the urgency of these steps, citing their importance in ensuring fairness within the tax system, protecting law-abiding taxpayers, and combatting the tax gap.

It's important to note that the IRS does not intend to increase audits for households earning less than $400,000 annually.

Understanding the Tax Gap

The tax gap represents the disparity between estimated owed taxes and the actual timely payments made to the IRS. It comprises three primary components: non-filing, underreporting, and underpayment.

- Non-filing: This occurs when individuals fail to file their annual tax returns on time, resulting in delayed tax payments. Reasons for non-filing can vary, from concerns about substantial tax debts to personal crises such as divorce or bereavement.

- Underreporting: Underreporting transpires when individuals do not fully disclose their income, often seen when those paid in cash neglect to report these earnings on their returns. This practice can lead to lower tax payments than what is actually owed.

- Underpayment: Underpayment signifies that taxes have been reported but not paid in a timely manner. This situation can affect freelancers or gig workers who miscalculate their estimated taxes or individuals who owe the IRS but delay settling their dues.

It's worth noting that approximately 85% of taxes are paid voluntarily and on time, highlighting the importance of addressing these compliance challenges to close the tax gap.

IRS Offers Relief for Employers Hit by ERC Scams

In a bid to assist employers who have fallen prey to scams related to the Employee Retention Credit (ERC), the Internal Revenue Service (IRS) has introduced a new initiative. This decision comes after the IRS temporarily suspended the processing of new ERC claims due to a significant surge in submissions, largely driven by aggressive promotion from entities known as "ERC mills."

Here's a closer look at this development:

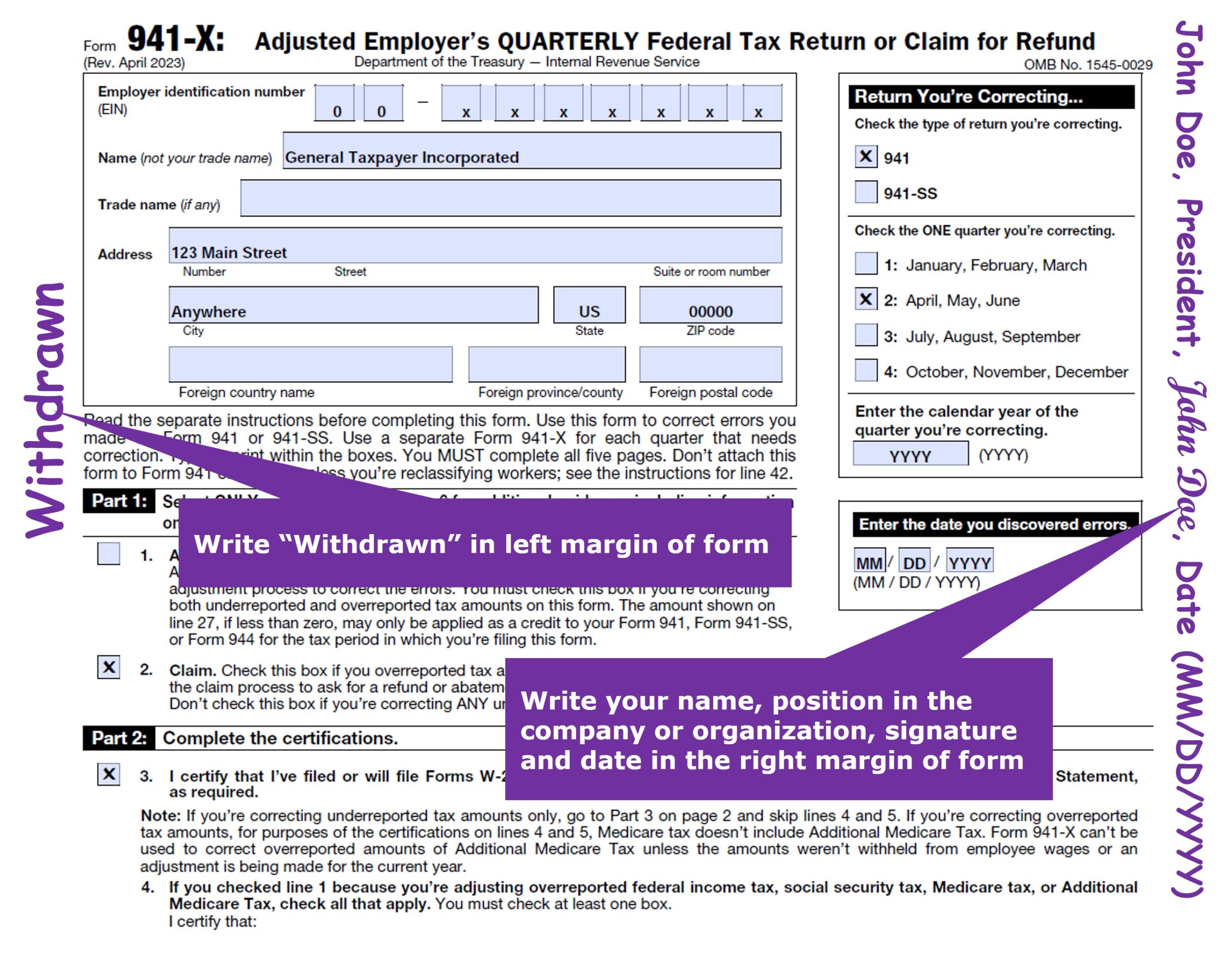

A Way Out: Employers who have already filed ERC claims but have yet to receive refunds can now opt to withdraw their submissions. This withdrawal option has been designed to help these employers steer clear of future repayment responsibilities, as well as interest and penalties.

Eligibility Criteria for Withdrawal: To qualify for the withdrawal process, employers must meet specific conditions:

- They must have submitted the ERC claim through an adjusted employment return (Forms 941-X, 943-X, 944-X, CT-1X).

- The adjusted return should have been filed exclusively to claim the ERC, with no other alterations.

- The employer must wish to withdraw the entire ERC claim.

- Importantly, the IRS should not have issued payment for their claim, or if payment was made, it shouldn't have been cashed or deposited.

No Penalties or Interest: Employers who choose to withdraw their claims will not face any penalties or interest, and the IRS will treat these claims as if they were never submitted.

This IRS initiative aims to protect well-intentioned businesses that may have been misled by the aggressive marketing tactics of certain entities promoting the ERC. It underscores the importance of employers remaining cautious and well-informed about the ERC, while also avoiding costly loans or falling victim to scams.

For detailed instructions on how to withdraw an ERC claim and additional relevant information, please visit IRS.gov/withdrawmyERC.

The IRS remains committed to supporting small businesses and organizations as they navigate the complexities surrounding the Employee Retention Credit. If you have questions or require further assistance, please don't hesitate to reach out.

Stay informed and stay protected.

Guilty Plea from IRS Contractor for Unauthorized Tax Return Disclosure and Theft

Charles Littlejohn, a 38-year-old IRS contractor from Washington, D.C., has admitted guilt in a case of unauthorized disclosure of tax return information. Initially charged with this offense on September 29, 2023, Littlejohn's guilty plea signifies a waiver of indictment.

Court records reveal that between 2017 and 2021, Littlejohn was employed by an undisclosed consulting firm, servicing both public and private clients. As part of his responsibilities, he worked on contracts linked to the IRS, involving the disclosure of tax returns and return information for tax administration purposes.

During 2018 to 2020, Littlejohn unlawfully accessed tax returns and related information belonging to an individual referred to in court documents as "Public Official A." Although not explicitly named, this individual is widely presumed to be former President Donald Trump.

Littlejohn disclosed this tax information to an unidentified media outlet, referred to as "News Organization 1" in legal documents. In September 2020, this outlet published a series of articles based on Public Official A's tax returns, which aligns with The New York Times' reporting.

Additionally, court records indicate that Littlejohn provided returns and return information spanning over 15 years, involving thousands of the country's wealthiest individuals, to "News Organization 2." This second entity, although not explicitly named in the charges, appears to correspond with ProPublica's 2021 reporting.

ProPublica has declined to comment on the plea hearing, while The New York Times has not yet responded to requests for comment.

Littlejohn's actions included accessing these returns via an IRS database, using expansive search parameters to obscure his intentions. He subsequently circumvented IRS protocols designed to detect and prevent large data transfers from IRS systems, saving the tax returns to multiple personal storage devices, including an iPod.

IRS Grants Extension to Taxpayers Affected by Hurricane Lee in Maine and Massachusetts

Hurricane Lee, a significant event during the 2023 Atlantic hurricane season, left its mark on the northeastern United States earlier this year. In response, the IRS has introduced tax relief measures for both individuals and businesses impacted by the storm in Maine and Massachusetts. These taxpayers now have until February 15, 2024 to file their 2022 tax returns.

Eligible Recipients

The IRS extends its relief to all areas officially designated as disaster zones by the Federal Emergency Management Agency (FEMA). As a result, individuals and businesses located in the following Maine counties can take advantage of this tax relief: Androscoggin, Aroostook, Cumberland, Franklin, Hancock, Kennebec, Knox, Lincoln, Oxford, Penobscot, Piscataquis, Sagadahoc, Somerset, Waldo, Washington, and York.