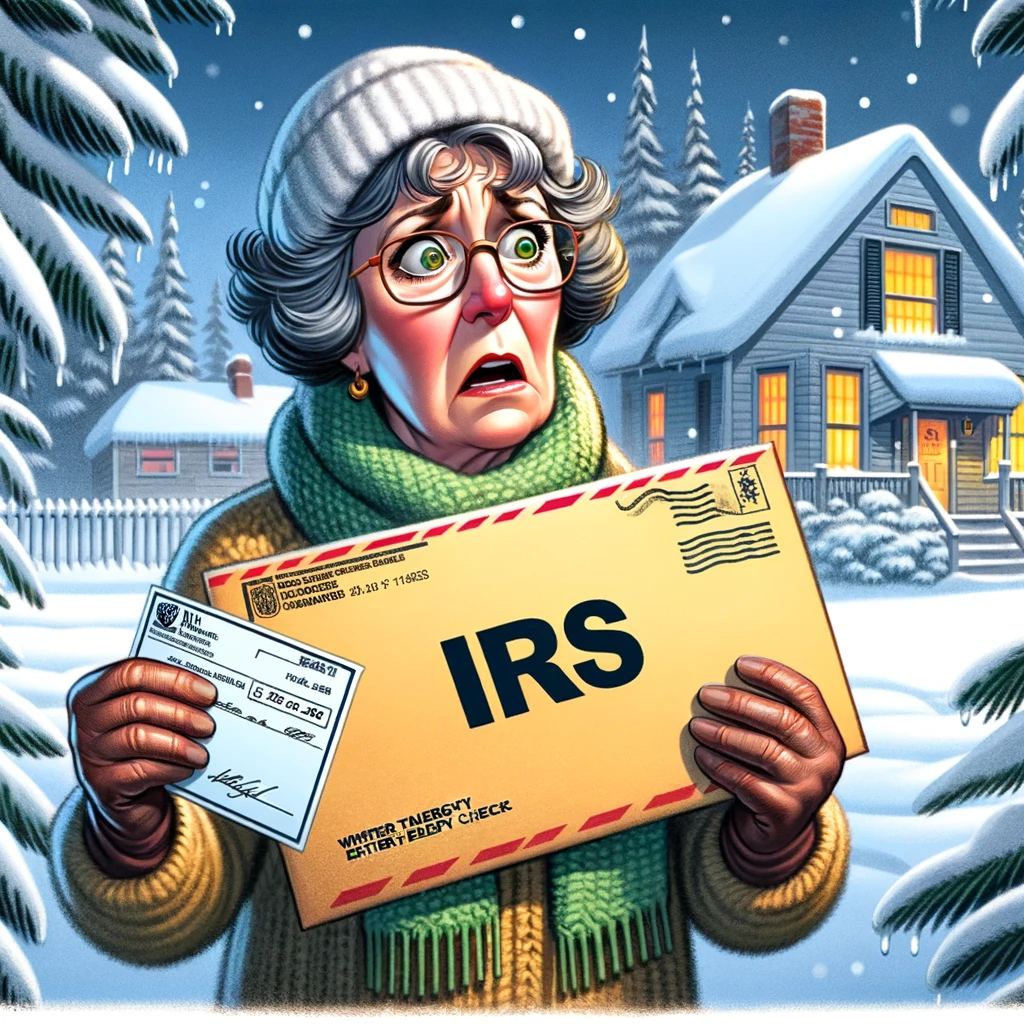

IRS Changes Course: Tax Implications for Maine’s Winter Energy Relief Checks

In an unexpected policy reversal, the Internal Revenue Service (IRS) has announced its decision to tax the Winter Energy Relief checks issued to approximately 880,000 residents of Maine. This move contradicts the IRS’s earlier assurance to the state government that these funds would be tax-free, stirring significant concern and frustration among the beneficiaries.

Earlier this year, Mainers welcomed a $450 per person Winter Energy Relief payment, provided by the state to help ease the financial burden of high energy costs during the colder months. These payments, initially communicated as non-taxable, offered much-needed respite to families grappling with economic challenges.

However, the IRS’s recent announcement has taken many by surprise. Residents like Marjorie Hunt from Durham express deep disappointment, pointing out how this unexpected tax demand increases their taxable income, resulting in a heftier tax bill than anticipated.

We echo the sentiments of many when we says that no one wants to pay extra tax on funds that were not only unrequested but were also meant as a relief measure. This reveals a growing sense of frustration among our clients, some of whom now regret accepting the aid due to the looming tax implications.

Despite these concerns, there are varied reactions among the recipients. A taxpayer from Brunswick, for example, believes that despite the tax, the relief payment still offers a net benefit. Yet, she and her husband are disappointed by the IRS’s inconsistency, criticizing the agency for its sudden policy flip-flop.

The tax implications of this decision are not uniform and will vary depending on individual tax brackets and filing statuses. It’s estimated that individuals and families could see an additional federal tax burden ranging from $50 to $200 because of these relief checks.

While the state of Maine is not taxing these payments, Governor Mills has publicly expressed a commitment to defending the interests of Mainers. The state government is actively appealing to the IRS, urging the agency to stick to its original promise of not taxing the Winter Energy Relief payments.

This situation highlights the complexities and unpredictability of tax policies, particularly when it comes to relief measures in times of economic strain. As Mainers navigate this unexpected twist, the broader conversation turns to the implications of such policy reversals on public trust and the efficacy of relief programs. Stay tuned as we continue to follow this developing story, providing insights and updates on the state’s efforts and the IRS’s response.

Let’s find your way to tax and accounting peace of mind

Let us be part of your journey towards success.