Unprecedented Tax Hikes Loom Over Maine Cities and Towns as Expenses Continue to Surge

Maine municipalities grapple with unprecedented tax hikes as expenses continue to soar. While Westbrook's city budget was being developed, it was evident that all costs would rise.

City officials proposed a "status quo" budget, excluding new positions or programs and reducing investments in streets, sidewalks, and public safety purchases. They also suggested transferring $1 million from the undesignated fund balance to counteract unavoidable expenses.

However, with a $3.2 million increase in school spending, residents could face an 8.8% tax hike, the largest in the city's history.

Mayor Michael Foley acknowledges the difficulty of the situation, noting that skyrocketing prices for housing, food, fuel, energy, and other essentials are already putting pressure on residents.

Municipalities throughout southern Maine are in the midst of the annual budget process, attempting to balance the escalating costs of goods and services with the goal of minimizing tax impact. Large school budgets are further straining finances.

In many communities, staff had to create proposals without knowledge of school budgets.

In South Portland, the $45 million budget is down almost 15% from the current year, largely due to a $10 million reduction in General Assistance. However, when combined with the school budget, overall city spending could lead to a 4% increase in the tax rate.

Rising costs are affecting other municipalities as well, with North Yarmouth's proposed $4.4 million budget potentially raising the tax rate by 3% or more.

In Portland, the proposed $261 million budget includes a 6.1% tax increase, which could have been much higher if staff had not worked to reduce it.

In addition to inflation, many municipalities face staffing challenges. To attract and retain employees in a competitive labor market, officials are prioritizing wage increases and other incentives.

For example, Westbrook's budget does not include new positions but will invest over $1 million in pay and benefits. In Brunswick, the cost of salaries and benefits for existing employees rose by nearly $1.8 million, the largest portion of the town's $4.1 million spending increase.

Municipalities are seeking ways to remain competitive and retain staff while trying to minimize the impact on taxpayers.

School budgets play a significant role in determining state tax rates, as they constitute a considerable portion of a state's annual expenditure. Funding for education primarily comes from local property taxes, state revenue sources, and federal grants. As school budgets increase, the demand for additional funding sources grows, which may result in higher tax rates or adjustments to existing tax allocations.

Rising school budgets can be attributed to various factors such as increasing student enrollment, higher teacher salaries, improved infrastructure, and expanded educational programs. Additionally, the inflation rate influences the cost of goods and services required by schools, such as textbooks, technology, and transportation.

When school budgets increase, state governments may be compelled to raise tax rates to accommodate the growing expenses. This can lead to an increase in property taxes, income taxes, or sales taxes. Alternatively, states may opt to reallocate funds from other areas of the budget to cover education expenses, potentially impacting public services or infrastructure projects.

The impact of school budgets on state tax rates may vary depending on the state's economic stability and revenue sources. In some cases, states with robust economies and diverse revenue streams may be able to absorb increased education costs without significantly affecting tax rates. However, in economically strained states, rising school budgets can lead to noticeable tax increases for residents.

Ultimately, the relationship between school budgets and state tax rates reflects the challenge that governments face in prioritizing and allocating resources to meet the needs of their constituents while maintaining fiscal responsibility.

Biden's Tax Proposals: Potential Impacts on Baby Boomer and Family-Owned Businesses

President Joe Biden's 2024 budget proposals include several tax changes that could significantly affect small businesses and their finances.

The proposed budget features increases in the top capital gains rate for incomes over $1 million, the elimination of the "step-up in basis" loophole, expansion of who must pay investment income tax and the rate at which it is paid, and an increase in the corporate tax rate.

NFIB President Brad Close warns that the $2.5 trillion in proposed tax hikes could hinder the growth and job creation potential of Main Street businesses. He also claims that some tax increases are being misrepresented as closing "tax loopholes" and would directly impact small businesses.

Despite the challenges faced by small businesses due to inflation, hiring pressures, and other adverse business conditions, tax experts remain skeptical about the likelihood of Biden's proposals passing as they currently stand. Many provisions have been previously suggested, and a divided Congress reduces the chances of their adoption without revisions.

The budget attempts to rebalance some of the cuts made by The Tax Cuts and Jobs Act of 2017, particularly for higher-income individuals, according to Eric Hylton, National Director of Compliance at Alliantgroup.

Biden's proposal includes raising the top individual tax rate from 37% to 39.6% and changing the income threshold to $400,000 for single taxpayers and $450,000 for married couples filing jointly. This change would be effective for taxable years beginning after December 31, 2022, potentially impacting more businesses.

Ray Beeman, leader of Ernst & Young's Washington Council, stresses the importance of small business owners staying informed about proposed tax changes, as they could resurface at a later time.

Five key provisions in Biden's budget that business owners should be aware of include:

- Higher capital gains tax rate: The proposed increase in the top marginal rate on long-term capital gains and qualified dividends to 44.6% for income over $1 million could negatively affect small business owners looking to sell, especially Baby Boomers approaching retirement.

- Elimination of the "step-up in basis" rule: The proposed change would impact family businesses passing assets to the next generation, as few exceptions exist for capital gains tax consequences. However, Biden's budget does partially address these concerns by exempting $5 million of unrealized gains per individual and $10 million per married couple.

- Loss of leverage in real estate transactions: The proposed elimination of 1031 like-kind exchanges over $500,000 for individual taxpayers and $1 million for married couples filing jointly could affect small businesses' ability to leverage their capital in real estate transactions.

- Higher corporate tax rate: While most small businesses are pass-through entities not subject to corporate income tax, Biden's proposal to raise the corporate tax rate from 21% to 28% would impact those that are. Congress will need to consider the implications for the U.S. compared to other developed countries.

- Potential increase in net investment income tax: The proposed increase of the 3.8% net investment income tax rate on small business income over $400,000 to 5% could lead to more small businesses paying this tax and at a higher rate than currently in place.

The Importance of Keeping Tax Records: When Can You Safely Dispose of Them?

After submitting your annual tax return to the Internal Revenue Service (IRS), you may want to put taxes out of your mind. However, organizing and storing your tax records is crucial for protecting yourself in case of a future IRS audit. While the general rule is to keep your tax records for three years, there are several exceptions where you may need to retain them for a longer period. This article will guide you on how long to keep your tax records and when you can safely discard them.

Understanding the Statute of Limitations

The statute of limitations for the IRS to audit your tax return is typically three years. For an income tax return, the limitation period is also three years. However, the IRS advises keeping your tax returns for a longer duration, as this will provide the necessary documentation to defend yourself in case of an audit. The statute of limitations starts running from the later of the tax return due date or the date you file your taxes.

Exceptions to the General Rule

- Worthless Securities or Bad Debts: If you claim a deduction for worthless securities or bad debts, you should keep your records for seven years. For instance, if you lent a friend $10,000 under a promissory note, and they went bankrupt without repaying, maintain records to prove the legitimacy of the unpaid debt discharged in bankruptcy.

- Employment Taxes: Retain records for employment taxes for four years from the later of the date the tax is due or the date you pay the tax.

Property-Related Records

If your tax return includes property-related information, keep these records until the statute of limitations (usually three years) expires for the year you sell or otherwise dispose of the property. For example, if you purchased a car in 2010, used it for your business, and sold it in 2020, retain all car-related tax records until the statute of limitations ends for your 2020 tax return.

Furthermore, when exchanging property, keep your old property records until the statute expires for the tax year you dispose of the new property. If you use a 1031 exchange to sell a rental property and invest the proceeds tax-free into a new rental property, keep the old rental property records until the statute expires for the tax year you sell the replacement property.

Extended Statutes of Limitations

In some cases, the statute of limitations exceeds three years. For example, if you fail to report income amounting to more than 25% of your reported income for that year, the IRS has six years to audit your return. Moreover, not filing or filing a fraudulent tax return permits the IRS to audit you indefinitely, so retain tax records for those years permanently.

Storing Your Tax Documents

Consider keeping your tax documents in a fireproof safe or a bank's safe deposit box. To save space, you can scan your tax-related documents and store them on an external hard drive or a cloud service. The IRS accepts electronic copies, provided they are legible and can be reproduced.

In conclusion, understanding the rules for keeping tax records can help safeguard you in the event of an IRS audit. Be mindful of the various exceptions and circumstances that may require you to store your tax records for a longer period, and ensure that you store them safely and securely.

A Bold Plan to Abolish Income Tax in Maine Faces Resistance

As Maine lawmakers continue to debate the possibility of eliminating income tax in the state, the controversial proposal is garnering attention from residents and businesses alike. The bill, which aims to phase out income tax over five years, starting in 2024, is currently facing strong opposition from Democrats, who control both the House and Senate in Maine's State House. Despite the bill's uncertain fate, its proponents argue that this bold move could lead to significant financial benefits for Maine's residents and businesses.

The bill, proposed by Representative David Boyer of Poland, is designed to gradually decrease the state's income tax each year, allowing each state department to adjust their annual budgets accordingly. Boyer believes that this incremental approach provides departments with enough time to identify wasteful spending and make necessary cuts. He argues that while the state's budget has increased by about 20% since the last budget, there hasn't been a commensurate improvement in services, like roads and other infrastructure.

However, opponents of the bill worry that eliminating income tax would leave the state with insufficient funding to fulfill its obligations. This concern is echoed by House Speaker Mark Eves, a Democrat, who stated that Maine's tax system is broken and rigged for those at the very top. He believes that the Governor's proposal would only make the situation worse.

The idea of eliminating income tax in Maine isn't new. In 2015, then-Governor Paul LePage proposed amending the state's constitution to permanently prohibit the Legislature from imposing income tax on any person, beginning in 2020. LePage's two-year budget plan aimed to make up for lost revenues by increasing sales taxes, cutting off state revenue sharing with local municipalities, and taxing some non-profit groups.

However, LePage's proposal was met with strong resistance from Democrats, who immediately rejected the idea. They instead offered a counter-proposal that would decrease but not eliminate income tax, lower property taxes, and keep sales tax unchanged.

If Maine were to enact the proposed bill and eliminate income tax, it would join the ranks of the 10 states that have partially or entirely abolished their income tax. Currently, seven states have no income tax, while New Hampshire and Tennessee tax only dividend and investment income.

As the bill's future hangs in the balance, Boyer acknowledges that it's unlikely to pass in its current form. However, he remains committed to fighting for tax breaks wherever possible, in the hopes of easing the financial burden on Maine's large population of retirees living on fixed incomes and benefiting higher-income "job creators."

Over the next 4-6 weeks, the bill is expected to reach the House floor, where its fate will be decided. In the meantime, the debate over the elimination of income tax in Maine continues to stir up strong opinions on both sides of the aisle. Whether the bill ultimately succeeds or fails, the conversation surrounding Maine's tax system and potential reforms is unlikely to fade away anytime soon.

IRS Unveils Comprehensive Plan for Utilizing $80 Billion in Additional Funding

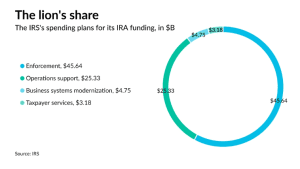

In a comprehensive report submitted to the Secretary of the Treasury, the Internal Revenue Service (IRS) has outlined its strategic operating plan for the next ten years. The plan specifies how the agency will make use of the additional $80 billion in funding it recently received to enhance customer service, increase its capacity to scrutinize large corporations and high-income individual taxpayers, and modernize its outdated systems and technology infrastructure.

Newly appointed IRS Commissioner Danny Werfel has stated that the plan envisions a bright future for both taxpayers and the IRS, with the latter undergoing a transformation in its operations and providing the services that taxpayers rightfully deserve. Werfel added that the IRS's future experience will be markedly different from its present-day version, thanks to significant improvements in service and technology.

The IRS has been working on the 150-page Strategic Operating Plan following the passage of the Inflation Reduction Act in August last year, which allocated $80 billion in fresh funding to the agency over a decade. The plan aims to address concerns regarding the utilization of these funds, as the announcement of the additional funding initially sparked fears that the IRS would target middle-class taxpayers and small businesses. This led to Republicans in Congress proposing to withdraw the funding.

According to the IRS, the $80 billion will be allocated to three key areas:

- To "rebuild and strengthen" customer service functions, which suffered significantly during the pandemic, resulting in notoriously long wait times on IRS phone lines;

- To enhance the agency's ability to audit high-income taxpayers (approximately 30,000 individuals earning more than $10 million annually) and complex large businesses; and,

- To modernize the agency's numerous outdated technology systems.

The strategic plan comprises 42 "key initiatives" and 190 "key projects" that the IRS will undertake over the next ten years, with the possibility of adding more projects as needed.

Although the plan mentions hiring nearly 30,000 new employees, including 5,000 customer service representatives, it does not clarify how many of these new hires will work in enforcement. However, since $45 billion out of the total $80 billion is earmarked for enforcement, it is likely that a significant number of new employees will be assigned to this area.

A substantial portion of the new hires will compensate for ongoing attrition and the long-term decline in funding and staffing levels. The IRS currently employs approximately 80,000 individuals, which is about 19% less than the 95,000 it employed in 2010.

Werfel emphasized that the agency has lacked the resources to provide the level of service taxpayers deserve for several years. He stated that the IRS is eager to demonstrate how the actions outlined in the plan will result in tangible improvements for taxpayers, with technology and in-person assistance serving as crucial components of this effort.

The commissioner claimed that the impact of the additional funding is already becoming apparent, with the first signs of change visible during this tax filing season. He cited the significant improvement in phone service thanks to increased staffing, the availability of more walk-in services nationwide, and the introduction of new digital tools as the initial steps in this transformative journey.

Introducing the Maine Property Tax Deferral Initiative

In January 2022, Maine introduced the Maine Property Tax Deferral Initiative, a critical loan program established under the Governor's Maine Jobs & Recovery Plan. This program helps eligible Maine residents aged 65 and above or those who are permanently disabled and unable to pay their yearly property taxes. The initiative aims to support Maine's most vulnerable citizens by enabling them to continue living in their homes while also ensuring that municipalities receive necessary property tax revenues. The loan must be repaid once the property is sold or becomes part of an estate.

Common Questions

What is the Maine Property Tax Deferral Initiative? The initiative is a program that enables specific individuals to defer (delay) payment of property taxes on their primary residences until they pass away, relocate, or sell their property. During the tax deferral period, the State reimburses the municipality for the deferred taxes. The deferred tax, along with interest, must be repaid to the State by the individual or their estate when they pass away, move, sell the property, or transfer the property (if a mobile or floating home) out of Maine.

Who is eligible for the program? To qualify, you must be at least 65 years old or unable to work due to a disability. Additionally, you must have an income of less than $40,000 and liquid assets of less than $50,000 (or $75,000 if filing a joint application).

Does my property qualify for the program? To be eligible, you must own and occupy the property as your primary residence and receive a homestead exemption on the property. The deferral covers your principal residence and up to 10 contiguous acres. If your homestead is within a multi-unit building, the qualifying property is the portion of the building used as your primary dwelling plus a percentage of the value of the common areas and land where the building stands.

When must I repay the deferred taxes? You may request removal from the program at any time and be responsible for repaying all deferred taxes plus interest. The following events also necessitate removal from the program and repayment of tax and interest on all deferred years:

- Your passing;

- Selling your homestead;

- No longer using the property as your homestead, except for health-related absences; or

- Removing a mobile or floating home from the State.

How to Apply

Property owners in seeking to join the program must submit their applications to the Assessing Department between January 1 and April 1. The Assessor will verify certain information before forwarding the application to Maine Revenue Services (MRS) for review. MRS may request additional details to confirm your eligibility.

Upon approval, you can continue deferring property taxes on your homestead in subsequent years, provided there is no change in circumstances leading to disqualification or removal.

Top 10 Tax Mistakes and How to Avoid Them

Tax season can be a stressful time for many people. With the myriad of forms, deductions, and ever-changing tax laws, it's easy to make mistakes that could cost you in the form of penalties, interest, or even audits. To help you navigate this tricky time, we've compiled a list of the top 10 most common tax mistakes and how to avoid them. Keep these tips in mind as you prepare your taxes to save time, stress, and money.

Filing late or not at all

One of the most common mistakes taxpayers make is missing the tax filing deadline or not filing a return at all. To avoid late fees and potential penalties, make sure to file your taxes on or before the deadline. If you need more time, consider filing for an extension, but remember that an extension only grants you extra time to file, not to pay your taxes. You'll still need to estimate and pay any taxes owed by the original deadline.

Incorrectly reporting income

Under-reporting or over-reporting your income can lead to discrepancies on your tax return, which can trigger an audit. To avoid this, carefully review all your income sources, including W-2s, 1099s, and other financial statements, before filing your taxes. If you find any discrepancies, contact the issuer to correct them before filing your return.

Forgetting deductions and credits

Many taxpayers miss out on valuable deductions and credits simply because they don't know they qualify. Before filing your taxes, do some research on the deductions and credits available to you. If you're unsure, consult a tax professional who can help you identify and claim these valuable tax savings opportunities.

Not keeping proper records

Failing to keep accurate records of your expenses and deductions can make it challenging to claim them on your tax return. Maintain organized records throughout the year to ensure you have the necessary documentation to back up your deductions and credits. This will not only help you file your taxes more accurately but also prepare you in the event of an audit.

Math errors

Math errors are a common reason for tax return adjustments and can lead to underpayment or overpayment of taxes. Double-check all calculations and ensure the information entered on your return is accurate. Using tax preparation software can also help reduce math errors.

Choosing the wrong filing status

Your filing status determines your tax bracket, standard deduction, and eligibility for certain credits and deductions. Filing under the incorrect status can result in overpayment or underpayment of taxes. Be sure to review the IRS guidelines for each filing status to determine which one is most appropriate for your situation.

Missing or incorrect Social Security numbers

Incorrect or missing Social Security numbers can result in a delayed or rejected tax return. Double-check all Social Security numbers on your return to ensure they are accurate and properly formatted.

Not double-checking direct deposit information

Direct deposit is a convenient way to receive your tax refund, but entering incorrect account information can delay or even misdirect your payment. Carefully review your account number and routing number before submitting your return to ensure your refund ends up in the right place.

Failing to report all sources of income

Forgetting to report all sources of income, such as freelance work, rental income, or stock dividends, can result in underpayment of taxes and potential penalties. Review your financial records thoroughly to ensure you've included all income sources on your return.

Not seeking professional help when needed

If you're unsure about any aspect of your tax return or need help navigating complex tax situations, it's wise to consult a tax professional. They can help ensure your return is accurate, identify potential tax savings, and provide peace of mind during this stressful time.

If you or someone you know needs tax help, reach out to Heritage Tax Company at (207) 888-8800. We work with a variety of taxpayers to solve a myriad of tax problems, ranging from back tax filing to tax planning. We look forward to working with you!

Pondering an Electric Vehicle? Discover the Latest Tax Credit Updates

As the Biden administration’s proposed regulation determining which vehicles are eligible for the updated EV tax credit takes effect on April 18, the range of qualifying vehicles will actually decrease.

President Joe Biden and automotive companies strive to significantly boost the number of electric vehicles on the streets and they face a dilemma. The federal tax credit, which allows American consumers to save up to $7,500 on an EV, comes with intricate prerequisites – including the stipulation that their batteries and components originate from the US or nations that have a free-trade agreement with it.

The Inflation Reduction Act, championed by Democratic Senator Joe Manchin of West Virginia, introduced these new tax credits. The aim was to shift the EV supply chain away from China, which has long held a dominant position in the sector.

However, achieving this objective could take years, and in the interim, it will significantly decrease the assortment of zero-emission vehicles that American taxpayers can purchase under the program.

Senior officials in the Biden administration have openly acknowledged that the new regulations will make it more challenging for consumers to capitalize on the updated tax credits in the "short-term."

"The stringent regulations on critical minerals and battery components will decrease the number of electric vehicles presently qualifying for the full credit in the short term, with the goal of incentivizing supply chains and manufacturing to relocate to the US," a senior US Treasury Department official informed journalists. "However, we anticipate that these criteria will substantially boost the production and sales of vehicles in the US over the next ten years."

Essentially, it might take automakers several years to establish the American-centric supply chain necessary to fulfill Manchin's vision, although they have welcomed this concept.

Manufacturers have acknowledged the bill's benefits for the US automotive industry, and it is already inspiring them to expand their domestic operations and employ thousands of new workers.

Thomas Boylan, a former Environmental Protection Agency official and the regulatory director for the EV trade group Zero Emission Transportation Association, stated that the timeline is "truly the million-dollar question."

Boylan further emphasized the importance of time, as electric vehicles are gaining significant traction but remain unaffordable for many buyers. He added that consumers interested in purchasing an EV and relying on tax credits for financial aid might be unwilling to wait years to acquire their desired vehicle.

The new tax credit and its accompanying guidelines are intricate, with more information expected to emerge in the coming weeks and months. Here's what you should be aware of:

How many EVs are presently eligible for federal tax credits? At present, 21 vehicles qualify for federal tax credits up to $7,500. This number will change on April 18 when the Treasury's updated guidance comes into effect.

How many EVs will be eligible for the new tax credit starting April 18? The exact number remains unknown. Senior administration officials have not provided an estimate, as automakers still need to ascertain which of their vehicles might qualify under the revised regulations. However, the number is expected to be considerably lower than 21.

Auto manufacturers will also identify eligible EVs. Ford Motor Company President and CEO Jim Farley stated that they would "assist customers in determining their eligibility for incentives" and promised to share more information "soon."

What does this mean for American consumers? Starting April 18, the most evident impact on consumers will be the reduced number of vehicles eligible for credits. Some currently qualifying cars will be excluded under the new regulation. As automakers strive to relocate their factories and supply chains to the US and other countries with free trade agreements, more vehicles will be added to the list, but this process could take months or even years.

Under the updated regulation, consumers can receive up to $7,500 in tax credits on eligible vehicles. There is no limit on the number of EVs manufacturers can sell with tax credits, provided those vehicles meet the criteria. This differs from the previous rule, which set a cap on the number of vehicles eligible for tax incentives.

What does the new EV tax credit regulation entail, and why is it complex?

The latest Treasury regulation on EVs originates from the Inflation Reduction Act, a climate and clean energy legislation passed by Congress last year. Senator Manchin, who contributed significantly to the IRA, modified the federal EV tax credits to shift the supply chain for critical minerals—essential for items like EV batteries, solar panels, and smaller rechargeable batteries—away from China.

Two key prerequisites must be met by automakers for their EVs to qualify for the $7,500 tax credit: a critical mineral requirement and a battery component requirement, each worth $3,750.

The critical mineral requirement stipulates that a specific percentage of the value of critical minerals powering EV batteries (such as lithium, nickel, graphite, and copper) must be extracted, processed, or recycled in the US or a country with a free-trade agreement. The battery component requirement mandates that a certain percentage of the battery component's value must be manufactured or assembled in North America.

Notably, these requirements will gradually increase over several years. For critical minerals, the percentage begins at 40% in 2023 and rises annually to 80% by 2027. For battery components, the percentage starts at 50% and escalates each year to 90% by 2028.

Officials and experts agree that implementing these rules in a brief period is incredibly complicated. White House senior adviser John Podesta told CNN, "They're just quite complex."

Under the new rule, the US will have free trade agreements on critical minerals with 21 countries: Australia, Bahrain, Canada, Chile, Colombia, Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras, Israel, Jordan, Korea, Mexico, Morocco, Nicaragua, Oman, Panama, Peru, Singapore, and Japan.

Chile and Australia are particularly noteworthy, as both possess abundant lithium supplies and extensive mining operations. Senior administration officials noted that the new rule would make lithium from these countries more competitive, potentially redirecting it to Japan or Korea, or even straight to the US, instead of China. Korea, Mexico, and Japan have significant car assembly operations, and many of their vehicles are sold in the US.

President Biden has stated that the US is also negotiating to add the European Union to the list, with the possibility of including more countries in the future.

What other updates can we expect in the guidance?

Administration officials are developing further guidance to prohibit auto companies from using minerals sourced from foreign entities of concern, like China, in their electric vehicles eligible for the tax credit.

This proposal has yet to be introduced and will eventually apply to battery components starting in 2024 and critical minerals beginning in 2025.

How long might it take to establish a critical mineral supply chain in eligible countries? Recent months have witnessed numerous announcements from car companies relocating their EV and battery production facilities to the US and neighboring countries.

However, experts and officials agree that the initial phase of the critical mineral supply chain—mining and refining critical minerals—will be the most challenging aspect to modify, primarily because China maintains a strong hold on it. The US has only a few lithium mines, located in Nevada. Several companies are competing to initiate lithium mining around California's Salton Sea, but no commercial operations have started yet.

Boylan explained that the Department of Energy "can give a loan to build a battery manufacturing facility," but "it's a whole different ballgame from talking about permitting an open-pit lithium mine."

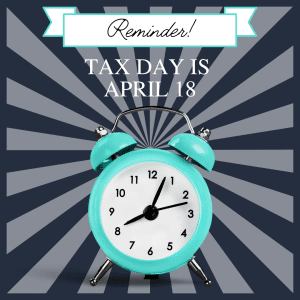

Tax Deadline 2023: Key Dates and Deadlines

The traditional tax deadline is April 15; however, in 2023, federal taxes are due on Tuesday, April 18, with exceptions for those affected by severe storms in California, Georgia, and Alabama. Residents in those areas have until October 16, 2023, to file their returns.

April 18 is also the deadline for filing a tax extension and making contributions to a traditional IRA, Roth IRA, SEP IRA, Health Savings Account (HSA), or solo 401(k) for the 2022 tax year.

Tax day is not on April 15 this year because it falls on a Saturday. While the next business day would usually be tax day (Monday, April 17), that day is also the District of Columbia's local holiday, Emancipation Day, which the IRS observes. Thus, the tax deadline is on the following business day, April 18.

Important Dates to Remember:

Extension Deadline: October 16, 2023 If you file for an extension, your federal returns are due on October 16, 2023. This is the final deadline for your 2022 federal tax return. Extensions grant an additional six months to file, but tax liability payments are still due by April 18. An extension to file does not extend the deadline to pay taxes.

Three methods for requesting an extension:

File an extension through your tax-filing software or on the IRS website via a partnered software provider. Eligible taxpayers can access free extension services.

Make estimated payments using your tax software (if supported) or on the IRS website via Direct Pay, Electronic Federal Tax Payment System, or debit/credit card.

Request an extension by mail using Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. Send the form with a check or money order if there is a tax balance due. Mailing addresses depend on your state of residency.

For employers who filed an extension by April 18, the deadline to make 2022 contributions to SEP IRAs and solo 401(k) is also October 16, 2023.

Severe Storm Relief Deadline: October 16, 2023 The IRS has extended the filing deadline to October 16, 2023, for victims of severe storms in California, Georgia, and Alabama. This extension allows affected taxpayers additional time to file, make tax payments, and contribute to 2022 IRA accounts. The relief is granted to declared-disaster areas by the Federal Emergency Management Agency (FEMA).

Solar Tax Credit 2023: Understanding the Federal Tax Credit

In 2022, the Federal Government offers compensation for installing solar panels in your home, potentially providing a significant tax break when filing your tax returns this year. The solar tax credit, offered by the U.S. Government, can cover up to 30% of the cost of installing a solar-powered system in your home.

In 2022, the Federal Government offers compensation for installing solar panels in your home, potentially providing a significant tax break when filing your tax returns this year. The solar tax credit, offered by the U.S. Government, can cover up to 30% of the cost of installing a solar-powered system in your home.

What is the Federal Solar Tax Credit?

The Internal Revenue Service (IRS) defines the federal solar tax credit as an investment tax credit (ITC). This incentive aims to encourage investment in products and services that the government supports. In 2022, President Joe Biden signed the Inflation Reduction Act, extending solar tax credits through 2034 as part of the U.S. Government's efforts to reduce the global carbon footprint.

The tax credit, officially known as the residential clean energy credit, isn't limited to solar power. It can cover expenses like equipment and installation but doesn't apply to structural work supporting panels. In some cases, the solar tax credit can be combined with state incentives and utility-funded programs promoting clean energy.

How Does the Solar Tax Credit Function?

The solar tax credit amount depends on the total expenditure on a completed project. It applies to homeowners who install a qualifying system between 2017 and 2034. For 2022, the IRS states that the solar tax credit is 30% for taxpayers filing in 2023. With this credit, savings on an average solar installation can reach $7,500. The 30% rate remains in effect until 2032, decreasing twice in the subsequent two years, eventually reaching 22%. It's important to note that the solar tax credit doesn't provide cash back but significantly reduces energy expenses.