The Importance of Keeping Tax Records: When Can You Safely Dispose of Them?

After submitting your annual tax return to the Internal Revenue Service (IRS), you may want to put taxes out of your mind. However, organizing and storing your tax records is crucial for protecting yourself in case of a future IRS audit. While the general rule is to keep your tax records for three years, there are several exceptions where you may need to retain them for a longer period. This article will guide you on how long to keep your tax records and when you can safely discard them.

Understanding the Statute of Limitations

The statute of limitations for the IRS to audit your tax return is typically three years. For an income tax return, the limitation period is also three years. However, the IRS advises keeping your tax returns for a longer duration, as this will provide the necessary documentation to defend yourself in case of an audit. The statute of limitations starts running from the later of the tax return due date or the date you file your taxes.

Exceptions to the General Rule

- Worthless Securities or Bad Debts: If you claim a deduction for worthless securities or bad debts, you should keep your records for seven years. For instance, if you lent a friend $10,000 under a promissory note, and they went bankrupt without repaying, maintain records to prove the legitimacy of the unpaid debt discharged in bankruptcy.

- Employment Taxes: Retain records for employment taxes for four years from the later of the date the tax is due or the date you pay the tax.

Property-Related Records

If your tax return includes property-related information, keep these records until the statute of limitations (usually three years) expires for the year you sell or otherwise dispose of the property. For example, if you purchased a car in 2010, used it for your business, and sold it in 2020, retain all car-related tax records until the statute of limitations ends for your 2020 tax return.

Furthermore, when exchanging property, keep your old property records until the statute expires for the tax year you dispose of the new property. If you use a 1031 exchange to sell a rental property and invest the proceeds tax-free into a new rental property, keep the old rental property records until the statute expires for the tax year you sell the replacement property.

Extended Statutes of Limitations

In some cases, the statute of limitations exceeds three years. For example, if you fail to report income amounting to more than 25% of your reported income for that year, the IRS has six years to audit your return. Moreover, not filing or filing a fraudulent tax return permits the IRS to audit you indefinitely, so retain tax records for those years permanently.

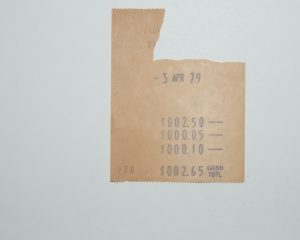

Storing Your Tax Documents

Consider keeping your tax documents in a fireproof safe or a bank’s safe deposit box. To save space, you can scan your tax-related documents and store them on an external hard drive or a cloud service. The IRS accepts electronic copies, provided they are legible and can be reproduced.

In conclusion, understanding the rules for keeping tax records can help safeguard you in the event of an IRS audit. Be mindful of the various exceptions and circumstances that may require you to store your tax records for a longer period, and ensure that you store them safely and securely.

Let’s find your way to tax and accounting peace of mind

Let us be part of your journey towards success.