IRS Unveils Comprehensive Plan for Utilizing $80 Billion in Additional Funding

In a comprehensive report submitted to the Secretary of the Treasury, the Internal Revenue Service (IRS) has outlined its strategic operating plan for the next ten years. The plan specifies how the agency will make use of the additional $80 billion in funding it recently received to enhance customer service, increase its capacity to scrutinize large corporations and high-income individual taxpayers, and modernize its outdated systems and technology infrastructure.

Newly appointed IRS Commissioner Danny Werfel has stated that the plan envisions a bright future for both taxpayers and the IRS, with the latter undergoing a transformation in its operations and providing the services that taxpayers rightfully deserve. Werfel added that the IRS’s future experience will be markedly different from its present-day version, thanks to significant improvements in service and technology.

The IRS has been working on the 150-page Strategic Operating Plan following the passage of the Inflation Reduction Act in August last year, which allocated $80 billion in fresh funding to the agency over a decade. The plan aims to address concerns regarding the utilization of these funds, as the announcement of the additional funding initially sparked fears that the IRS would target middle-class taxpayers and small businesses. This led to Republicans in Congress proposing to withdraw the funding.

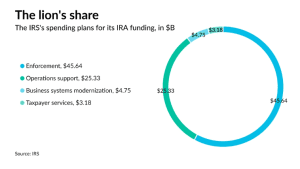

According to the IRS, the $80 billion will be allocated to three key areas:

- To “rebuild and strengthen” customer service functions, which suffered significantly during the pandemic, resulting in notoriously long wait times on IRS phone lines;

- To enhance the agency’s ability to audit high-income taxpayers (approximately 30,000 individuals earning more than $10 million annually) and complex large businesses; and,

- To modernize the agency’s numerous outdated technology systems.

The strategic plan comprises 42 “key initiatives” and 190 “key projects” that the IRS will undertake over the next ten years, with the possibility of adding more projects as needed.

Although the plan mentions hiring nearly 30,000 new employees, including 5,000 customer service representatives, it does not clarify how many of these new hires will work in enforcement. However, since $45 billion out of the total $80 billion is earmarked for enforcement, it is likely that a significant number of new employees will be assigned to this area.

A substantial portion of the new hires will compensate for ongoing attrition and the long-term decline in funding and staffing levels. The IRS currently employs approximately 80,000 individuals, which is about 19% less than the 95,000 it employed in 2010.

Werfel emphasized that the agency has lacked the resources to provide the level of service taxpayers deserve for several years. He stated that the IRS is eager to demonstrate how the actions outlined in the plan will result in tangible improvements for taxpayers, with technology and in-person assistance serving as crucial components of this effort.

The commissioner claimed that the impact of the additional funding is already becoming apparent, with the first signs of change visible during this tax filing season. He cited the significant improvement in phone service thanks to increased staffing, the availability of more walk-in services nationwide, and the introduction of new digital tools as the initial steps in this transformative journey.

Let’s find your way to tax and accounting peace of mind

Let us be part of your journey towards success.