A Paycheck in Crypto? There Might Be Some Unexpected Headaches

Cryptocurrencies (eg. Bitcoin, Dogecoin, etc) have been on an upswing after months of declines, giving some credence to those who say digital currencies are resilient and on the verge of becoming more widely accepted.

While it's too difficult to predict anything when it comes to cryptocurrencies, more people are getting paid or wanting to be paid, in this method. They cite the ease and transparency of payments in digital currencies, especially when employers and employees aren't based in the same country.

There are some important considerations to keep in mind. Aside from the volatility, a misstep could result in not getting compensated correctly or creating potential trouble with the Internal Revenue Service and state agencies.

U.S. employers may be resistant to compensation in cryptocurrencies at the outset. It's a lot more work for them when withholding some of the income that's required to pay FICA (Social Security and Medicare) taxes. If an employee is paid in digital coins, employers have to deal with additional accounting and the converting of some of that income into U.S. dollars to pay those federal taxes.

Some may find that employers would prefer to classify them as contractors rather than employees so they can push the withholding burden onto workers, who would then be considered self-employed.

For contractors, it's imperative they request a 1099-NEC form, which is what's used to report income from the companies they work for. They should ask for details listing when individual units of cryptocurrency were received and the price for each. Doing so will help those receiving this form of compensation to calculate their tax liabilities accurately.

Note that non-employees are responsible for paying the self-employment tax (a 15.3% tax that goes toward Social Security and Medicare). Software such as cryptotrader.tax and bitcoin.tax can help with record-keeping.

Recipients owe ordinary income tax on whatever the fair market value of the coins is when they receive them. They'll also face capital gains taxes when they sell or swap the coins for other digital currencies. If it's within a year, they'll be subject to short-term capital gains tax rates (which are generally the same as ordinary income tax rates), or if it's longer then they'll face long-term capital gains tax rates (0%, 15% or 20%, depending on their tax bracket).

Since tax isn't automatically withheld by employers for contractors, those workers are usually advised to make estimated tax payments each quarter rather than face a big bill when they file their returns. With cryptocurrencies, it can be difficult to estimate what's owed, so self-employed workers should consider paying 100% (or 110%, if they earn more than $150,000) of what they paid the prior year. This will help avoid any underpayment penalties when they square up at the end of the tax year.

Some cryptocurrency devotees may be reluctant to sell any holdings to make those estimated payments and would rather face the underpayment penalty. That could be a red flag to the IRS to open up an audit.

It's wise to hash out with an employer ahead of time when the value of cryptocurrency compensation is being calculated. Is it when a work period ends? Or when payment is due?

Given the volatility of the cryptocurrency market, a few days can make a big difference in what's paid out. It's also helpful to agree on how to compensate for things like paid vacation days. Whatever it is, workers need to make sure it's clearly stated and not just at the discretion of the employer.

Those working for crypto-focused companies may be given compensation in the form of private tokens that aren't traded as easily as Bitcoin, Ethereum or Litecoin. Figuring out the fair market value of those tokens can be tricky when calculating tax owed, but token holders shouldn't use that as a free pass to ignore reporting requirements.

In addition, those coins may be granted as bonus compensation that vests, similar to stock options, but there's an important distinction. With stock options, the recipient has the ability to recognize some of the income sooner to pay less tax in the future. It's likely that the IRS wouldn't allow a private token-holder to make the same election.

The smartest approach for those interested in getting paid in digital currencies is usually a hybrid, with some compensation in cryptocurrencies and some in dollars. For those more bullish on the future of digital currencies, it's better to just invest in them outright than gamble with your paycheck.

Does the IRS Disagree with Your Income Figures? 7 Critical Steps to Take Next

It is one of the scariest things that can befall a taxpayer - the dreaded notice from the IRS stating you owe them more money you can’t pay. When you open up the mailbox and see the return address of the tax agency staring back at you, your

It is one of the scariest things that can befall a taxpayer - the dreaded notice from the IRS stating you owe them more money you can’t pay. When you open up the mailbox and see the return address of the tax agency staring back at you, your

Few people look forward to communicating with the IRS, but plenty of taxpayers receive these notices every year. If you do find yourself on the receiving end of such a notice, knowing what to do next could make all the difference, and possibly save your bank account. Here are seven critical steps to take if the IRS disagrees with the income (or expense) figures you have reported.

Note: If you fall behind on filing your taxes, you’re not alone and we can help. Reach out to our tax resolution firm and we’ll help you file late tax returns and negotiate with the IRS if you owe back taxes. (207) 888-8800

1. Stop panicking. Getting a letter from the IRS is enough to send your heart racing, but it is not the end of the world, and panic will not help you.

Staying calm and reviewing the communication will be key, so settle your nerves and move on to the next steps.

2. Review the document carefully. The letter you received from the IRS should clearly lay out where they disagree with your figures and what they used to come up with their own math. Reviewing these figures is the critical next step, and it is one you should take your time with.

3. Pull a copy of the tax return in question. The communication you received from the IRS will tell you which year's tax return is in question, so pulling a copy of that return should be your next step. Once you have the document in hand you can start to review the figures and see where the discrepancies came from.

4. Find your supporting documents. In many cases these kinds of discrepancies are caused by simple errors like transposed numbers, so compare the figures on the supporting documents to what ended up on your return. You may find, for instance, that you reported interest of $2,150 as $1,250, and the solution could be as simple as ponying up the extra tax.

5. Contact the best tax resolution firm. If you used a professional tax preparer, you might be tempted to talk to them first. That might be ok, but if you owe a large amount of back taxes, they might not be able to help.

That’s where a good tax relief or tax resolution firm can help. The best tax relief firms can actually negotiate on your behalf with the IRS and find the best resolution for your tax situation, sometimes settling for less than what you owe in taxes!

6. Review the response form. If you did make a mistake on your tax return, you can simply agree to the figures the IRS reported and pay the additional tax, along with any applicable penalties and interest. If you disagree, you can respond with the supporting documents that prove your case. Either way you will need to use the response form included with the letter, so review and complete that form carefully. We don’t suggest you do this yourself, instead, call our tax relief firm and make sure you investigate the issue in its entirety. Otherwise, you could land yourself in more trouble.

7. Follow up. It can take some time for these kinds of discrepancies to be resolved, so you will need to bring a healthy dose of patience. If you agree with the notice and choose to pay the extra tax, you can see when your check is cashed or the money is taken out of your account, documenting the situation and keeping careful records. If you disagree, you will need to wait for the IRS to respond, but make sure you don’t assume the issue is resolved unless you have documentation stating that.

If you do need to contact the IRS, keep in mind that their phone lines are extremely busy. Many people who have been through this trauma recommend calling early in the morning, right after the phone lines open, so you can get in line and get your questions answer before the lines fill up.

We NEVER suggest our clients try to contact the IRS on their own. It would be like going to court without a lawyer. The IRS is not your friend, they’re sole responsibility in these cases is to collect taxes they think they’re owed.

Hopefully you will never be on the receiving end of a nasty letter from the IRS but it is still important to be prepared. If you do find a letter from the IRS in your mailbox, following the seven critical steps listed above could save you from further trouble.Reach out to our tax resolution firm and we’ll schedule a free, no-obligation confidential consultation to explain your options in full to permanently resolve your tax problem. (207) 888-8800

IRS direct deposit? How to tell if it's a tax refund or credit.

While the IRS is scrambling to distribute various types of payments to millions of taxpayers, deposits are showing up unexpectedly in millions of people’s bank accounts.

Many people were surprised to wake up to an additional tax refund on Wednesday, after the IRS corrected their 2020 returns and determined—due to changes in the tax law that allowed people to claim up to $10,400 in non-taxable unemployment benefits—that they overpaid on unemployment compensation. The IRS is sending hard-copy notices to people who are owed refunds, the money often shows up by direct deposit before the letter arrives—leaving many recipients pleasantly surprised, albeit a little suspicious.

It’s been a similar situation with the monthly advance payments for the child tax credits. No matter how many tweets and press releases the IRS sends out to inform people of the pay schedule, social media still buzzes with shocked recipients each time a payment is made.

The Taxpayer Advocate Service (TAS) put out an update that breaks down the reference codes for three types of payments. These are the codes that appear in your bank account along with the funds. Each code starts with “IRS TREAS 310,” but then the code descriptions differ depending on the payment type. They are as follows:

- TAX REF: This is what shows up if your deposit is a refund, including the refunds that are now being distributed to unemployment recipients with corrected returns.

- TAXEIP3: This is the code that shows up for the third stimulus check, also known as Economic Impact Payments. Most, but not all, of those payments have been delivered.

- CHILDCTC: This is what shows up if you receive an advance payment for the child tax credit. Those are being distributed monthly through the end of the year.

The IRS is still processing some 2020 Individual tax returns and amended tax returns, on top of continuing to issue the third round of Economic Impact Payments (EIP3), all while also starting a new program to provide Advance Payment of the Child Tax Credit (AdvCTC) this year. All those various payments coming to eligible taxpayers can get confusing, especially since the notices with explanations that are issued based on those actions might not come right away in the mail.

Be aware that some of these refunds might come within days or weeks of each other. For instance, once a 2020 tax return gets processed, the IRS has the information it needs to be able to then generate the EIP3 (provided you qualify). That same tax information also alerts the IRS to issue the AdvCTC, if you qualify. If this happens, the IRS will automatically register you to begin receiving those monthly payments through the end of the year.

Returning a Refund, EIP, or AdvCTC

If for some reason, you believe you are not due a refund, or do not qualify for either or both of the other two payments, you can repay that amount. See the article titled Returning a Refund, Economic Impact Payment, or Advance Payment of the Child Tax Credit for full details.

Recurring Stimulus Payments?

Although the IRS has issued more than 169 million payments in the third round of direct stimulus aid, some lawmakers are pushing for a fourth round of stimulus aid that would effectively send recurring payments until the pandemic ends.

The first round of stimulus payments was in March 2020, issued under the Coronavirus Aid Relief and Economic Security Act (CARES Act) and delivered $1,200 to eligible adults and $500 for eligible dependents.

The second round of stimulus payments was in December 2020, issued under a December relief measure. This relief came in the form of $600 payments per eligible person.

The third round of stimulus payments was in March of 2021, issued under the American Rescue Plan. This payment was $1,400 per eligible person. Due to delays, more than 2 million people received the third round of stimulus payments in July.

Despite these measures, millions of Americans remain in financial distress and almost one-quarter of Americans are struggling to pay their household expenses, according to census survey data that polled people during the last two weeks of August (1).

Unemployment rates still stand at 5.2%, which are higher than the pre-pandemic level of 3.5%. Although businesses are hiring, there are still approximately 5.3 million fewer people on payroll today than before the pandemic.

9.1 million people lost enhanced unemployment benefits on Labor Day, which is when the federal benefits expired (2). This wipes out approximately $5 billion in weekly benefits that had been flowing to unemployed workers, many of whom used this aid to pay for groceries, rent, and other essentials. Many states had ended their unemployment extension earlier than planned.

2.8 million people have signed a Change.org petition (3) calling on lawmakers to pass legislation for recurring $2,000 monthly payments. Some lawmakers have picked up on the idea. Twenty-one senators, all Democrats, signed a letter on March 30 to President Biden in support of recurring stimulus payments. This letter has pointed out the obvious thought that the $1,400 payment sent out by the IRS will not hold people over for long.

Meanwhile, some states are creating their own forms of stimulus payments (4). The Golden State Stimulus (5) from California will provide $600 for low- and middle-income residents who have filed their 2020 taxes. Florida and parts of Texas have authorized bonuses for teachers to help offset the impact of the pandemic.

- Household Pulse Survey Data Tables

- Unemployment cliff looms as 9.1 million Americans set to lose aid by Labor Day

- $2000/month to every American

- Some U.S. states are issuing their own stimulus checks and cash bonuses

- Golden State Stimulus

IRS Trust Fund Recovery Penalty

When you have employees, you withhold their Medicare and Social Security contributions from their checks, and in most cases, you also withhold some income tax. These amounts are referred to as trust fund taxes, and you are obligated to send that money to the IRS.

If you fail to make those payments, the government can charge a very serious penalty called the Trust Fund Recovery Penalty.

What is the Trust Fund Recovery Penalty (TFRP)?

The Trust Fund Recovery Penalty is the penalty you face if you withhold income tax, Medicare, and Social Security payments from your employees’ paychecks, but you don’t send the money to the IRS. It is one of the largest penalties charged by the IRS. The agency takes it very seriously, and if you are deemed responsible for the missing payments, the IRS will not hesitate to take your personal assets to recoup their money.

Who Can Be Responsible for the TFRP?

The IRS can and will levy this penalty on anyone who willfully fails to collect and pay trust fund taxes. That includes owners, CEOs, and directors, but it can also include employees, third-party payroll administrators, outside accountants, and bookkeepers. For corporations, shareholders can also be held responsible, and for non-profits, members of the board of trustees may be considered responsible.

Essentially, anyone in the organization who collects or pays these taxes can be held responsible. In addition, anyone who knows the taxes aren’t being paid can also be held responsible. The IRS can hold multiple people responsible, and the agency will do what it takes to get the money.

To establish responsibility, the IRS has to prove that the individual in question was aware that the taxes were due and aware they weren’t being paid. The individual must have purposefully or willfully ignored the law. For example, if you or someone related to your organization took the money set outside for payroll and income taxes and used it to pay another bill, that’s a clear sign of willfulness.

How Much Is the Trust Fund Recovery Penalty Amount?

The Tax Fund Recovery Penalty is not small. In fact, it is equal to the amount of taxes that were unpaid. Once again, that includes any income taxes withheld from an employee’s paycheck plus the employee’s Social Security and Medicare contributions. Note that Social Security and Medicare contributions are also referred to as FICA (Federal Insurance Contributions Act) taxes.

To explain, let’s say you paid an employee $1,000. You noted on the paycheck stub that you withheld $100 for income tax plus $62 for Social Security and $14.50 for Medicare. However, you didn’t send any of that money to the IRS. In that case, the unpaid tax bill is $176.50. You owe that amount plus that amount again as a penalty. That doubles your bill.

With a single employee, that can be a lot over an extended period of time. With multiple employees, the numbers can be staggering.

What Happens If the IRS Assesses a Trust Fund Recovery Penalty?

If the IRS believes that a company hasn’t been paying its trust fund taxes, an officer from the agency starts an assessment to figure out who is responsible. As part of that process, the IRS requests multiple documents and lots of information from the company.

That includes bank statements and canceled checks, but it also includes details about who has passwords for online accounts and who knows PINs for bank cards. The IRS wants to see who’s paying the bills, who controls the money, and where the money is going.

The agency will likely also request articles of incorporation or partnership contracts to get a sense of the layout of power in the company. Then, when the agent hones in on a potentially responsible party or parties, the IRS will request an interview with those people.

What Is the Interview for a Trust Fund Recovery Penalty?

There’s a lot to understand about the interview process. Whether you are the owner of a company or just someone the IRS thinks is responsible for the missing taxes, you may be summoned.

How Can You Settle the Penalty?

Like other types of tax liabilities, there are options to pay this penalty. If you don’t have the full payment, you can apply for a payment plan or an installment agreement. Alternatively, you can try to settle the taxes owed for less than you owe through the Offer in Compromise program or through a partial payment installment agreement.

The important thing is to contact the IRS and set up an arrangement before the IRS tries to garnish your wages or seize your assets. You cannot discharge these penalties in bankruptcy.

What Are Non-Trust Fund Taxes?

To get a better understanding of trust-fund taxes, you should understand non-trust fund taxes. Trust fund taxes have that name because employees trust their employers to send the funds to the government on their behalf. Basically, employers are supposed to keep that money in a trust fund until they send it to the IRS. They are not supposed to do anything with the funds.

However, there are also non-trust fund taxes. In particular, employers must match their employees’ Social Security and Medicare contributions. Those matching amounts are considered non-trust fund taxes.

The IRS typically only holds the business responsible for non-trust fund taxes. It does not hold individuals responsible. However, the exact liability rules depend on your business structure. If you’re self-employed or the sole principal of an LLC, you may be held personally responsible for both trust-fund and non-trust fund taxes.

What Is the Statute of Limitations on the Trust Fund Recovery Penalty?

If the IRS assesses a penalty, it has up to 10 years to collect it. During that time, the IRS will take your assets if you are responsible.

However, the IRS only has 3 years to assess the penalty. This clock starts ticking on April 15 after the year the trust fund taxes were due to be filed. For instance, let’s say a company was supposed to pay some trust fund taxes in October 2016. The IRS has three years from April 15, 2017 to assess the penalty. If the IRS doesn’t do anything by April 14, 2020, it can’t do anything After that date, it’s illegal for the IRS to investigate or conduct interviews.

Source:https://taxcure.com/business/trust-fund-recovery

Still no unemployment tax refund? What to know about your IRS money.

Since May, the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around $1,600 to those who can claim an unemployment tax break. Here's why: The first $10,200 of 2020 jobless benefits ($20,400 for married couples filing jointly) was made nontaxable income by the American Rescue Plan in March. Taxpayers who filed their returns before the legislation and paid taxes on those benefits are entitled to a refund.

However, the last batch of refunds, which went out to some 1.5 million taxpayers, was over a month ago, and the remaining payment dates are unclear. The IRS hasn't issued a timeline for this month, except to say "summer," which officially ends Sept. 22. Some have reported on social media that their IRS tax transcripts show pending deposit dates. But other taxpayers are frustrated because they haven't received any money or updates at all. Some don't know if they should file an amended return or how to check the status of their refund online.

We'll explain below how to access your tax transcript for clues and why you should look out for an IRS TREAS 310 transaction on your bank statement. For other news, pandemic-era jobless aid -- including the $300 weekly bonus payments and coverage for freelancers -- ended on Labor Day, and is unlikely to be extended. If you're a parent receiving the child tax credit this year, check out how it could affect your taxes in 2022. This story gets updates on a regular basis.

What to know about the 2020 unemployment tax break

The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021. The tax break is for those who earned less than $150,000 in adjusted gross income and for unemployment insurance received during 2020. At this stage, unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

The $10,200 tax break is the amount of income exclusion for single filers, not the amount of the refund (taxpayers who are married and filing jointly could be eligible for a $20,400 tax break). The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits. So far, the refunds are averaging more than $1,600.

However, not everyone will receive a refund. The IRS can seize the refund to cover a past-due debt, such as unpaid federal or state taxes and child support. One way to know if a refund has been issued is to wait for the letter that the IRS is sending taxpayers whose returns are corrected. Those letters, issued within 30 days of the adjustment, will tell you if it resulted in a refund or if it was used to offset debt.

Refunds will go out as a direct deposit if you provided bank account information on your 2020 tax return. A direct deposit amount will likely show up as IRS TREAS 310 TAX REF. Otherwise, the refund will be mailed as a paper check to whatever address the IRS has on hand.

The IRS has put together a FAQ page if you have questions about eligibility. The IRS says eligible individuals should've received Form 1099-G from their state unemployment agency showing in Box 1 the total unemployment compensation paid in 2020. (If you didn't, you should request one online from that agency.) Some states may issue separate forms depending on the jobless benefits -- for example, if you received federal pandemic unemployment assistance, or PUA.

Payment schedule for unemployment tax refunds

With the latest batch of payments in July, the IRS has now issued more than 8.7 million unemployment compensation refunds totaling over $10 billion. The IRS announced it was doing the recalculations in phases, starting with single filers with no dependents and then for those who are married and filing jointly. The first batch of these supplemental refunds went to those with the least complicated returns in early summer, and batches are supposed to continue for more complicated returns, which could take longer to process.

According to an igotmyrefund.com forum and another discussion on Twitter, some taxpayers who filed as head of household or as married with dependents started receiving their IRS money in July or getting updates on their transcript with dates in August and September. No other official news from the IRS has been issued regarding payment schedule for this month.

How to use tax refund trackers and access your tax transcript

The first way to get clues about your refund is to try the IRS online tracker applications: The Where's My Refund tool can be accessed here. If you filed an amended return, you can check the Amended Return Status tool.

If those tools don't provide information on the status of your unemployment tax refund, another way to see if the IRS processed your refund (and for how much) is by viewing your tax records online. You can also request a copy of your transcript by mail or through the IRS' automated phone service by calling 1-800-908-9946.

Here's how to check your tax transcript online:

1. Visit IRS.gov and log in to your account. If you haven't opened an account with the IRS, this will take some time as you'll have to take multiple steps to confirm your identity.

2. Once logged in to your account, you'll see the Account Home page. Click View Tax Records.

3. On the next page, click the Get Transcript button.

4. Here you'll see a drop-down menu asking the reason you need a transcript. Select Federal Tax and leave the Customer File Number field empty. Click the Go button.

5. The following page will show a Return Transcript, Records of Account Transcript, Account Transcript and Wage & Income Transcript for the last four years. You'll want the 2020 Account Transcript.

6. This will open a PDF of your transcript: Focus on the Transactions section. What you're looking for is an entry listed as Refund issued, and it should have a date in late May or June.

If you don't have that, it likely means the IRS hasn't gotten to your return yet.

Who needs to file an amended return to claim the tax break

Most taxpayers don't need to file an amended return to claim the exemption. If the IRS determines you are owed a refund on the unemployment tax break, it will automatically correct your return and send a refund without any additional action from your end.

The only reason to file an amended return is if the calculations now make you eligible for additional federal credits and deductions not already included on your original tax return, like the Additional Child Tax Credit or the Earned Income Tax Credit. If you think you're now eligible for deductions or credits based on an adjustment, the most recent IRS release has a list of people who should file an amended return.

Tax transcript codes: 971, 846, 776, 290

Some taxpayers who've accessed their transcripts report seeing different tax codes, including 971 (when a notice was issued), 846 (the date and amount of a refund) and 776 (the amount of additional interest owed by the IRS). Others are seeing code 290 along with "Additional Tax Assessed" and a $0.00 amount. Since these codes could be issued in a variety of instances, including for stimulus checks and other tax refunds or adjustments, it's best to consult the IRS or a tax professional about your personalized transcript.

What to do if you're still waiting on your refund

It's best to locate your tax transcript or try to track your refund using the Where's My Refund tool (mentioned above). The IRS says that you can expect a delay if you mailed a paper tax return or had to respond to the IRS about your electronically filed tax return. The IRS makes it clear not to file a second return.

The IRS says not to call the agency because it has limited live assistance. The agency is juggling the tax return backlog, delayed stimulus checks and child tax credit payments. Even though the chances of speaking with someone are slim, you can still try. Here's the best number to call: 1-800-829-1040.

More about unemployment refunds

The IRS has provided some information on its website about taxes and unemployment compensation. But we're still unclear on the timeline for payments, which banks get direct deposits first or who to contact at the IRS if there's a problem with your refund.

Some states, but not all, are adopting the unemployment exemption for 2020 state income tax returns. Because some fully tax unemployment benefits and others don't, you might have to do some digging to see if the unemployment tax break will apply to your state income taxes.

Author: Oscar Gonzalez

Source: https://www.cnet.com/personal-finance/taxes/still-no-unemployment-tax-refund-what-to-know-about-your-irs-money/

The Latest IRS Headache for Taxpayers: 11 Million ‘Math Error’ Notices

Millions of Americans have gotten a scary, confusing letter from the Internal Revenue Service in 2021 saying they owe more taxes. Making matters worse, many of the letters are about stimulus payments meant to lessen the blow of the pandemic.

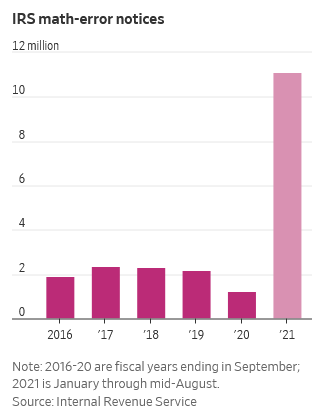

The explosion of IRS bills to taxpayers fall into a category known as “math-error” notices, and the IRS sent out more than 11 million of them from Jan. 1 to mid-August.

That compares with about 765,000 for the same period in pandemic-disrupted 2020 and about 2 million in 2019, according to National Taxpayer Advocate Erin Collins, who heads an independent unit within the IRS charged with safeguarding taxpayer rights. Ms. Collins is trying to help taxpayers who got these notices, and now several million filers will get more time to respond.

Despite their name, math-error notices aren’t just about arithmetic. Instead, they are tax adjustments for a variety of issues detected by IRS computers during return processing. They usually result in tax due, a smaller refund or even a higher refund in some cases.

When the letters assess taxes due or reduce refunds, as millions do, they are treacherous for filers because the first notice is also the final notice--unlike with many IRS letters. What’s more, the law assumes recipients have conceded if they don’t respond within 60 days.

The case then goes directly to the IRS’s dreaded collections process, so taxpayers often face liens or levies faster than with a conventional audit.

Yet the information in math-error notices is often so incomplete that they baffle even tax professionals.

Chastity Wilson, a former IRS lawyer now with professional-services firm CLA, says the firm currently has a client with a math-error assessment of $154,000 for an alternative-minimum-tax issue. But the IRS letter provided no explanation as to why, and the agency moved the case to collections despite timely requests for holds.

“It’s unfortunate we’ve gotten to this point,” Ms. Wilson says. “There’s no way this case should be in collections, and it makes taxpayers anxious and afraid.”

This year’s surge in math-error notices isn’t a huge surprise to pros. Ms. Collins says more than 80% of the mistakes involve filers’ claims for Recovery Rebate Credits, the term for stimulus payments claimed on tax returns. In the past, taxpayers have been confused by tax changes made in response to a crisis. After Congress enacted the Making-Work-Pay credit in the wake of the 2008 financial crisis, the IRS found more than 16 million errors involving it.

An IRS spokesman said the agency is streamlining procedures for 2022 based on what it learned this year, in part by sending taxpayers a letter saying what payments they’ve received.

What caught Ms. Collins’s attention when she researched this year’s letters is that the IRS omitted the crucial 60-day deadline on millions of math-error notices it sent involving Rebate Credits.

So, she pushed back and scored a win for taxpayers: Now about five million recipients of earlier notices will get a new, clearer one restarting the 60-day clock. An IRS spokesperson says the agency hasn’t determined when these letters will be mailed.

“Large agencies like the IRS inevitably make some mistakes, and good customer service requires they own them and fix them,” Ms. Collins said. “I commend the IRS for doing the right thing.”

Ms. Collins is also reminding all taxpayers—even those not getting a second letter—of their rights regarding math-error notices. For example, the IRS is supposed to drop an assessment and reconsider the case if a recipient simply requests an “abatement” during the 60-day response period. Even if the deadline has passed, the IRS should rescind the assessment if the filer provides evidence the agency was wrong.

She is also pressing the IRS to clarify these notices further, such as by adding the deadline for a response and providing more specifics on the errors.

The opacity of math-error notices is a longstanding issue for the IRS, one that has been raised repeatedly by the previous taxpayer advocate, Nina Olson, and others. When Congress gave the agency the ability to issue these notices in the 1970s to simplify some error resolutions, it required the agency to spell out the mistake. But many notices don’t do so.

“The IRS is at risk of having courts rule that these assessments are illegal because the notices seldom comply with the law’s language requiring them to explain the error,” says Leslie Book, a tax professor at Villanova University’s law school.

Source: https://www.wsj.com/articles/the-latest-irs-headache-for-taxpayers-11-million-math-error-notices-11630661402?mod=searchresults_pos3&page=1