The Latest IRS Headache for Taxpayers: 11 Million ‘Math Error’ Notices

Millions of Americans have gotten a scary, confusing letter from the Internal Revenue Service in 2021 saying they owe more taxes. Making matters worse, many of the letters are about stimulus payments meant to lessen the blow of the pandemic.

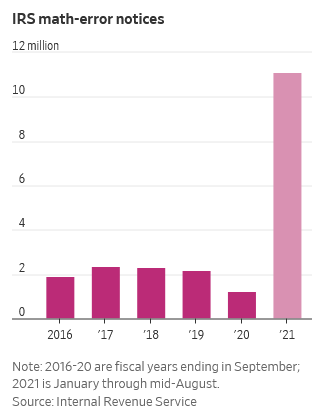

The explosion of IRS bills to taxpayers fall into a category known as “math-error” notices, and the IRS sent out more than 11 million of them from Jan. 1 to mid-August.

That compares with about 765,000 for the same period in pandemic-disrupted 2020 and about 2 million in 2019, according to National Taxpayer Advocate Erin Collins, who heads an independent unit within the IRS charged with safeguarding taxpayer rights. Ms. Collins is trying to help taxpayers who got these notices, and now several million filers will get more time to respond.

Despite their name, math-error notices aren’t just about arithmetic. Instead, they are tax adjustments for a variety of issues detected by IRS computers during return processing. They usually result in tax due, a smaller refund or even a higher refund in some cases.

When the letters assess taxes due or reduce refunds, as millions do, they are treacherous for filers because the first notice is also the final notice–unlike with many IRS letters. What’s more, the law assumes recipients have conceded if they don’t respond within 60 days.

The case then goes directly to the IRS’s dreaded collections process, so taxpayers often face liens or levies faster than with a conventional audit.

Yet the information in math-error notices is often so incomplete that they baffle even tax professionals.

Chastity Wilson, a former IRS lawyer now with professional-services firm CLA, says the firm currently has a client with a math-error assessment of $154,000 for an alternative-minimum-tax issue. But the IRS letter provided no explanation as to why, and the agency moved the case to collections despite timely requests for holds.

“It’s unfortunate we’ve gotten to this point,” Ms. Wilson says. “There’s no way this case should be in collections, and it makes taxpayers anxious and afraid.”

This year’s surge in math-error notices isn’t a huge surprise to pros. Ms. Collins says more than 80% of the mistakes involve filers’ claims for Recovery Rebate Credits, the term for stimulus payments claimed on tax returns. In the past, taxpayers have been confused by tax changes made in response to a crisis. After Congress enacted the Making-Work-Pay credit in the wake of the 2008 financial crisis, the IRS found more than 16 million errors involving it.

An IRS spokesman said the agency is streamlining procedures for 2022 based on what it learned this year, in part by sending taxpayers a letter saying what payments they’ve received.

What caught Ms. Collins’s attention when she researched this year’s letters is that the IRS omitted the crucial 60-day deadline on millions of math-error notices it sent involving Rebate Credits.

So, she pushed back and scored a win for taxpayers: Now about five million recipients of earlier notices will get a new, clearer one restarting the 60-day clock. An IRS spokesperson says the agency hasn’t determined when these letters will be mailed.

“Large agencies like the IRS inevitably make some mistakes, and good customer service requires they own them and fix them,” Ms. Collins said. “I commend the IRS for doing the right thing.”

Ms. Collins is also reminding all taxpayers—even those not getting a second letter—of their rights regarding math-error notices. For example, the IRS is supposed to drop an assessment and reconsider the case if a recipient simply requests an “abatement” during the 60-day response period. Even if the deadline has passed, the IRS should rescind the assessment if the filer provides evidence the agency was wrong.

She is also pressing the IRS to clarify these notices further, such as by adding the deadline for a response and providing more specifics on the errors.

The opacity of math-error notices is a longstanding issue for the IRS, one that has been raised repeatedly by the previous taxpayer advocate, Nina Olson, and others. When Congress gave the agency the ability to issue these notices in the 1970s to simplify some error resolutions, it required the agency to spell out the mistake. But many notices don’t do so.

“The IRS is at risk of having courts rule that these assessments are illegal because the notices seldom comply with the law’s language requiring them to explain the error,” says Leslie Book, a tax professor at Villanova University’s law school.

Source: https://www.wsj.com/articles/the-latest-irs-headache-for-taxpayers-11-million-math-error-notices-11630661402?mod=searchresults_pos3&page=1

Let’s find your way to tax and accounting peace of mind

Let us be part of your journey towards success.