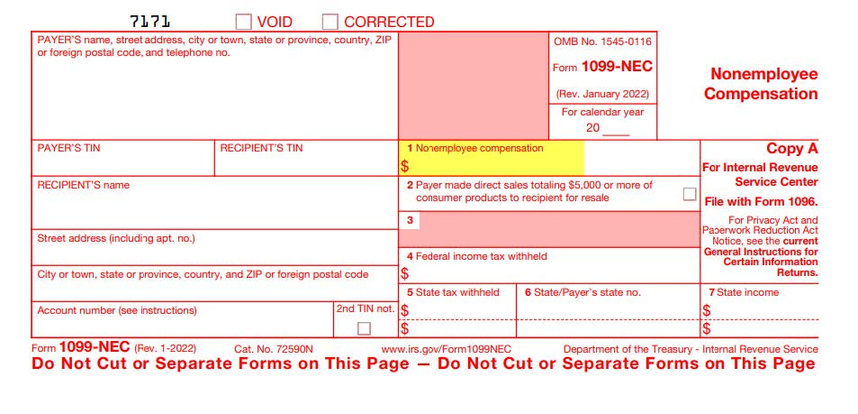

What to report on 1099-NEC

- Services performed by someone who is not your employee (including parts andmaterials) – Box 1

- “Services performed by someone who is not your employee (including parts andmaterials)” (Page 7 of IRS 1099 Instructions)

- “Enter nonemployee compensation (NEC) of $600 or more. Include fees,commissions, prizes and awards for services performed as a nonemployee, andother forms of compensation for services performed for your trade or businessby an individual who is not your employee” (Page 10 of IRS 1099 Instructions)

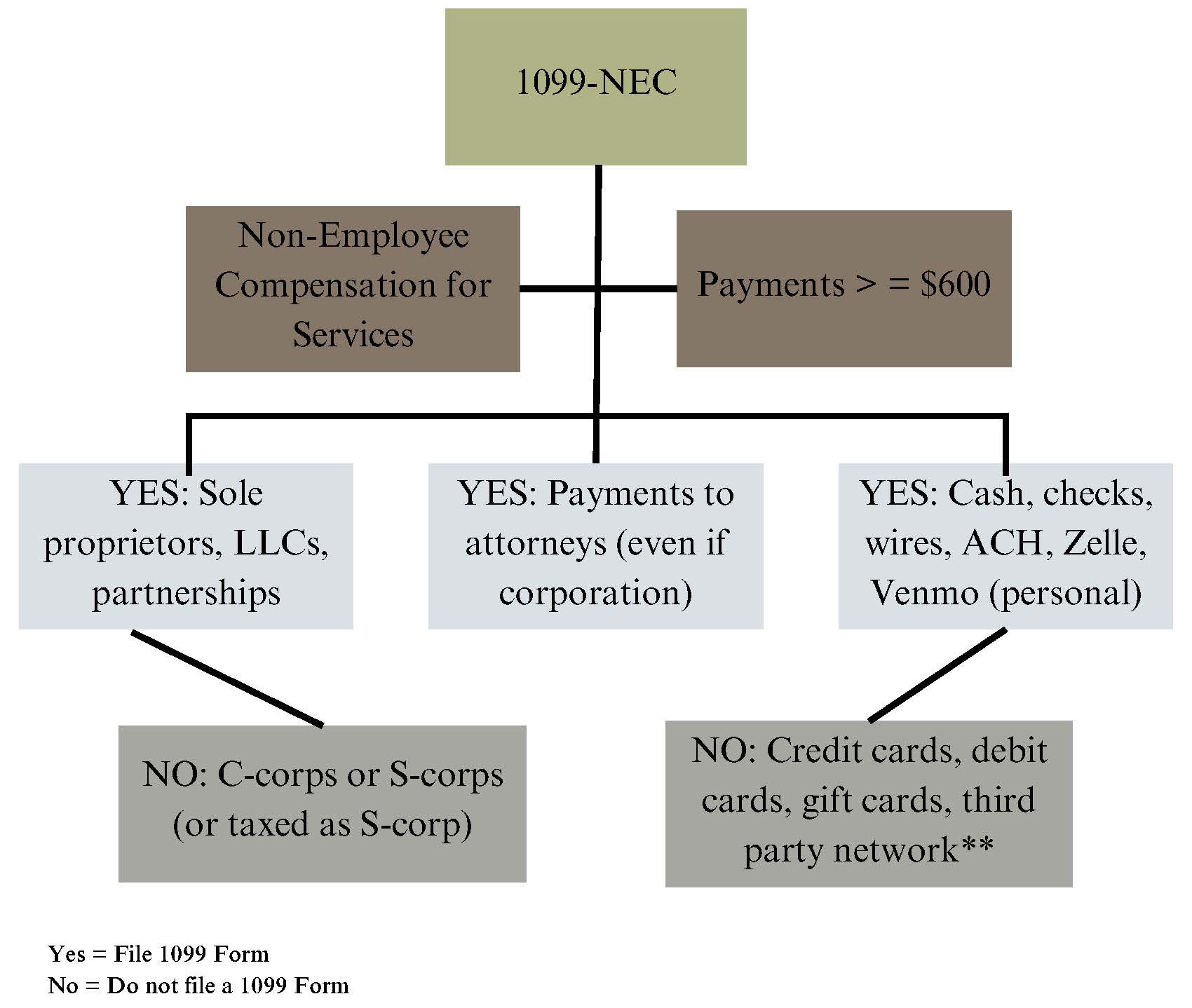

- There are exceptions for corporations (C-corp, S-corp, LLC taxed as C-corp orS-corp)

- Payments to an attorney – Box 1

IRS 1099 instructions: https://www.irs.gov/pub/irs-prior/i1099mec–2021.pdf (1099-NEC instructions start on page 7)

See exceptions on page 9 of IRS 1099 instructions: https://www.irs.gov/pub/irs-prior/i1099mec–2021.pdf

** Third party network – PayPal, merchant services, Venmo for Business, etc. Third party payment networks are responsible for issuing form 1099-K to recipients.

2022 1099-K rules – Transactions >= $20,000 and >=200 transactions

2023 1099-K rules – Transactions >= $600

FYI Third Party Networks

A third-party network transaction is a transaction where the funds are settled to the user through a third party network. A third-party payment network is any agreement or arrangement that provides for the following:

- A central organization establishes the accounts by a substantial number of providers of goods or services who are unrelated to the organization and who have agreed to settle transactions

- Standards and mechanisms for settling the transactions

- Guarantee of payment to the persons providing goods or services(participating payees) in settlement of transactions

See IRS announcement of delay for implementing $600 reporting threshold for third-party payment platforms: https://www.irs.gov/newsroom/irs-announces-delay-for-implementation-of-600-reporting-threshold-for-third-party-payment-platforms-forms-1099-k

FYI: Zelle is not considered a third-party payment platform, https://www.zellepay.com/faq/does-zelle-report-how-much-money-i-receive-irs

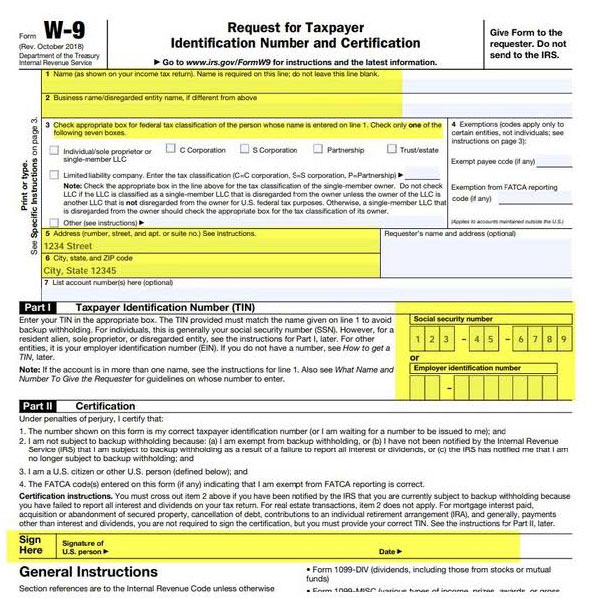

W-9 Forms

Form W-9: https://www.irs.gov/pub/irs-pdf/fw9.pdf

Best practice: Obtain W-9 form from every vendor.

Minimum requirement: Obtain W-9 from non-employees who provide services.

W-9 services (automate requesting W-9 form from vendors)

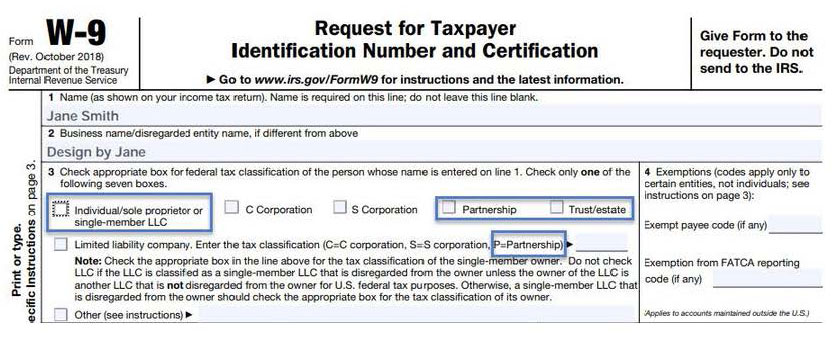

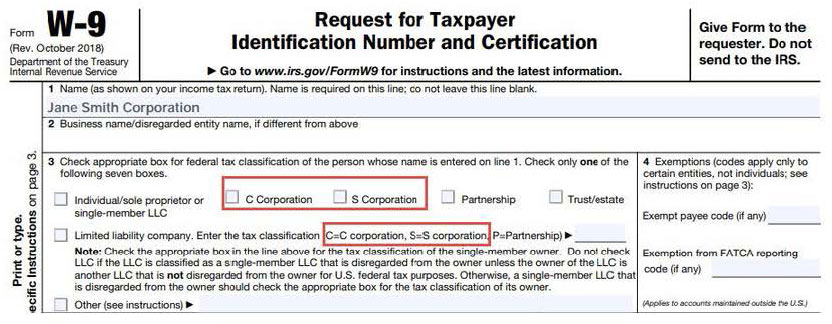

Sample W-9 Form. Vendor should fill out all highlighted items.

How to Review W-9 Form

ELIGIBLE FOR 1099 (must also meet criteria to receive Form 1099-NEC)

NOT ELIGIBLE FOR 1099

*Exception – attorneys are eligible for 1099’s even if they are set up or taxed as corporations (Corp or Scorp).

Next Steps

To work with us to file your 1099s, simple schedule an appointment.

To become a client, click the button below to apply.